Coincraze Central

Coincraze Central

用户暂无简介

- 赞赏

- 点赞

- 评论

- 分享

加纳对加密公司发放许可证的举动不仅仅是关于监管——而是关于生存。

在通货膨胀率达到13.7%、利率为28%以及塞地币剧烈波动的情况下,他们需要快速获得货币透明度。

加密货币并不是敌人。它已经被超过300万的加纳人使用——几乎每五个成年人中就有一个。

许可是如何将这种能量引入系统而不使其关闭。这是将混乱转化为政策的方法。

非洲在加密货币方面并没有落后。在许多方面,它正在悄然领先。

#Ghana # 加密货币 #DigitalAssets # 宏观 #Inflation # 政策 #CryptoAfrica

查看原文在通货膨胀率达到13.7%、利率为28%以及塞地币剧烈波动的情况下,他们需要快速获得货币透明度。

加密货币并不是敌人。它已经被超过300万的加纳人使用——几乎每五个成年人中就有一个。

许可是如何将这种能量引入系统而不使其关闭。这是将混乱转化为政策的方法。

非洲在加密货币方面并没有落后。在许多方面,它正在悄然领先。

#Ghana # 加密货币 #DigitalAssets # 宏观 #Inflation # 政策 #CryptoAfrica

- 赞赏

- 点赞

- 评论

- 分享

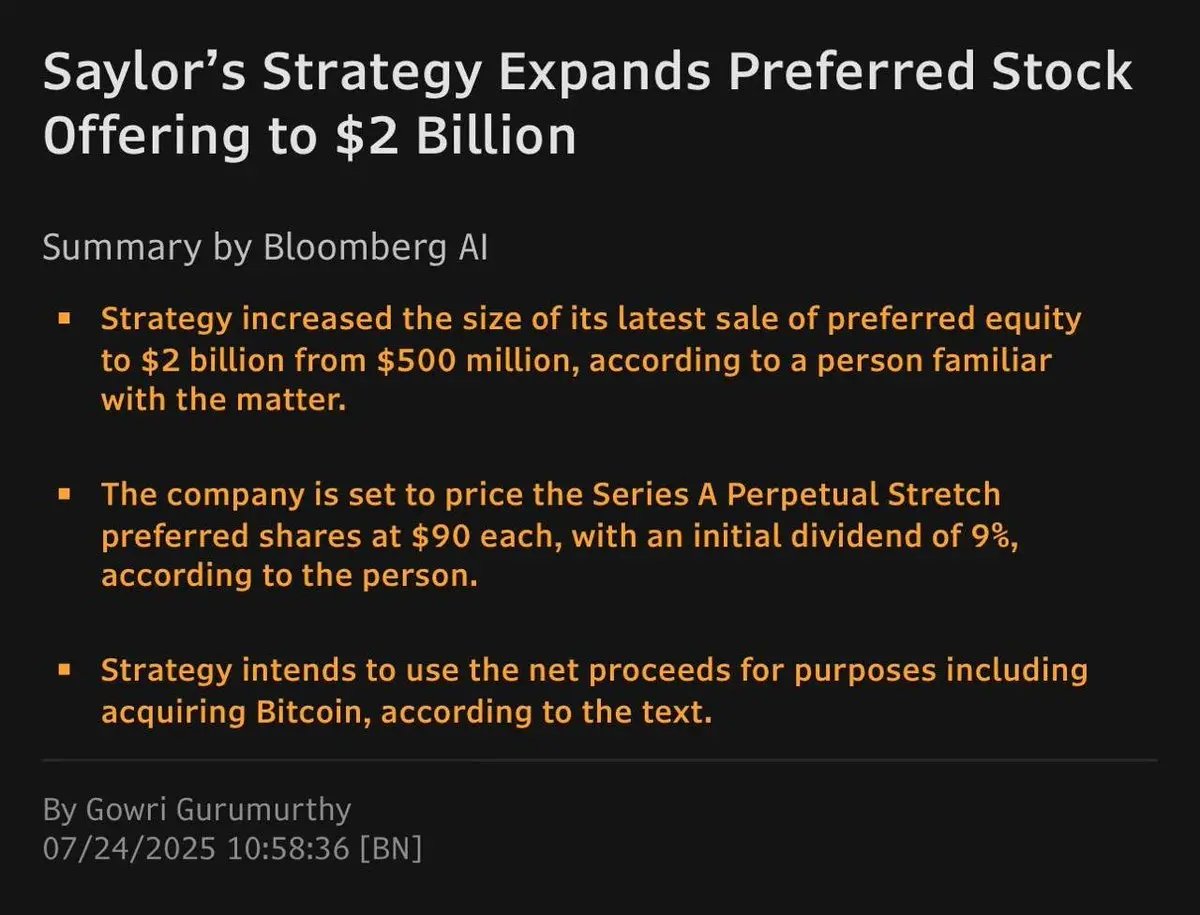

Strategy刚刚将其优先股募资规模从5亿美元扩大到20亿美元——没错,它正在用其中一部分去购买更多比特币。

这不仅仅是比特币的赌注了。这是资本市场工程。

追求收益的投资者可获得9%以上的浮动红利。

策略获得低成本的BTC敞口。每个人都赢——除非BTC暴跌或流动性枯竭。Saylor正在将比特币转变为一种财政策略——而资本市场正在大胆购买。

这很危险。但它有效。

#Bitcoin # 策略 #MichaelSaylor # 加密金融 #DigitalAssets # 优先股 #BTC # 宏观动向询问

查看原文这不仅仅是比特币的赌注了。这是资本市场工程。

追求收益的投资者可获得9%以上的浮动红利。

策略获得低成本的BTC敞口。每个人都赢——除非BTC暴跌或流动性枯竭。Saylor正在将比特币转变为一种财政策略——而资本市场正在大胆购买。

这很危险。但它有效。

#Bitcoin # 策略 #MichaelSaylor # 加密金融 #DigitalAssets # 优先股 #BTC # 宏观动向询问

- 赞赏

- 点赞

- 评论

- 分享

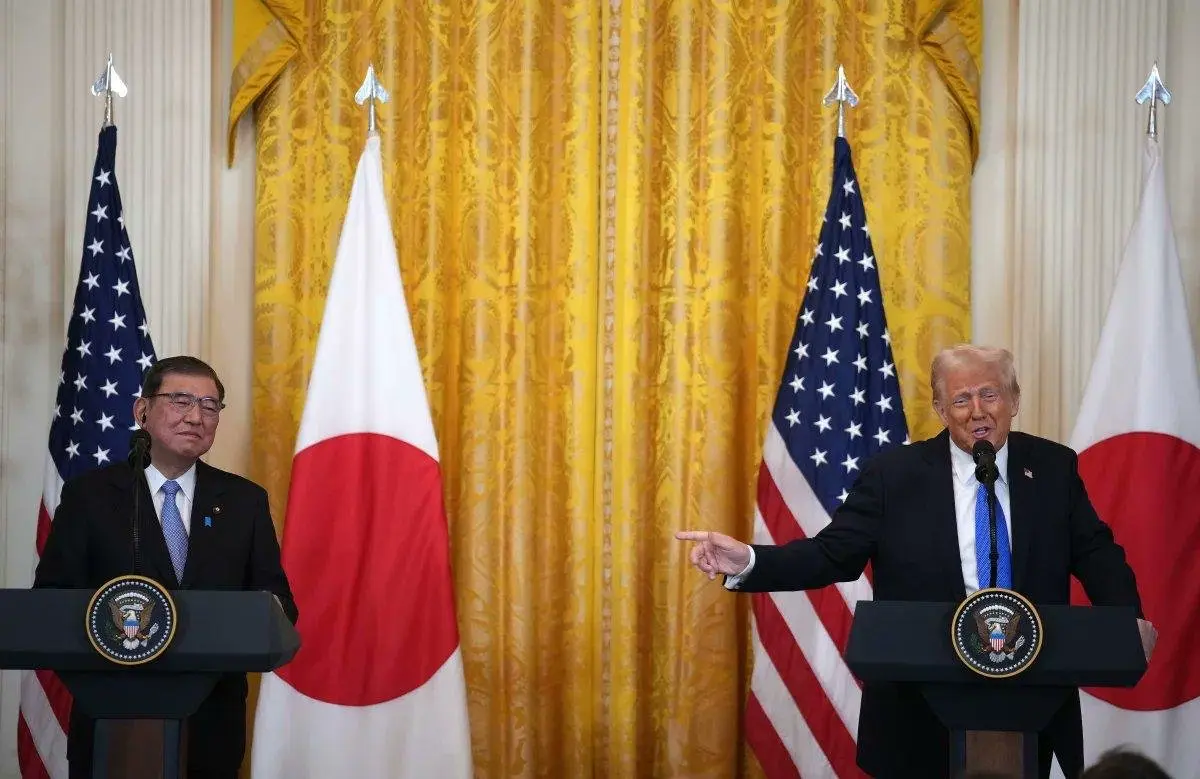

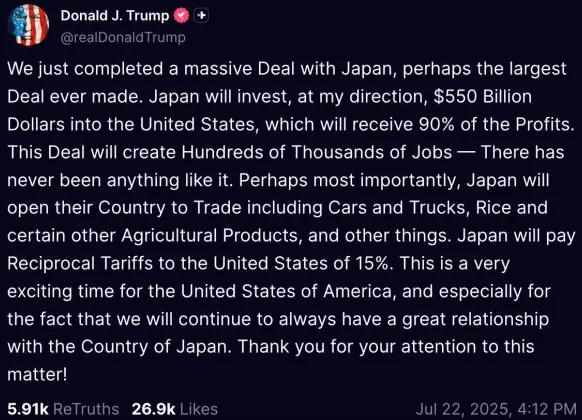

每个人都在庆祝价值5500亿美元的日本–美国交易。

但说实话——钱从哪里来?谁在签支票?

日本政府无法强迫私营公司在国外投资。

而且对项目结构、时间表或资本分配没有任何细节。

它在讲台上听起来很好。但在纸面上呢?这很模糊。

而现在财政部威胁如果日本不交货,将重新施加25%的关税。

这样的交易只有在资金流动是真实的,而不是口头的时才有效。

在那之前,这不是基础设施——这是杠杆。

#TradeDeal # 地缘政治 #Japan # 美国 #Tariffs # 全球金融 #Markets # 资本流动

查看原文但说实话——钱从哪里来?谁在签支票?

日本政府无法强迫私营公司在国外投资。

而且对项目结构、时间表或资本分配没有任何细节。

它在讲台上听起来很好。但在纸面上呢?这很模糊。

而现在财政部威胁如果日本不交货,将重新施加25%的关税。

这样的交易只有在资金流动是真实的,而不是口头的时才有效。

在那之前,这不是基础设施——这是杠杆。

#TradeDeal # 地缘政治 #Japan # 美国 #Tariffs # 全球金融 #Markets # 资本流动

- 赞赏

- 点赞

- 评论

- 分享

- 赞赏

- 点赞

- 评论

- 分享

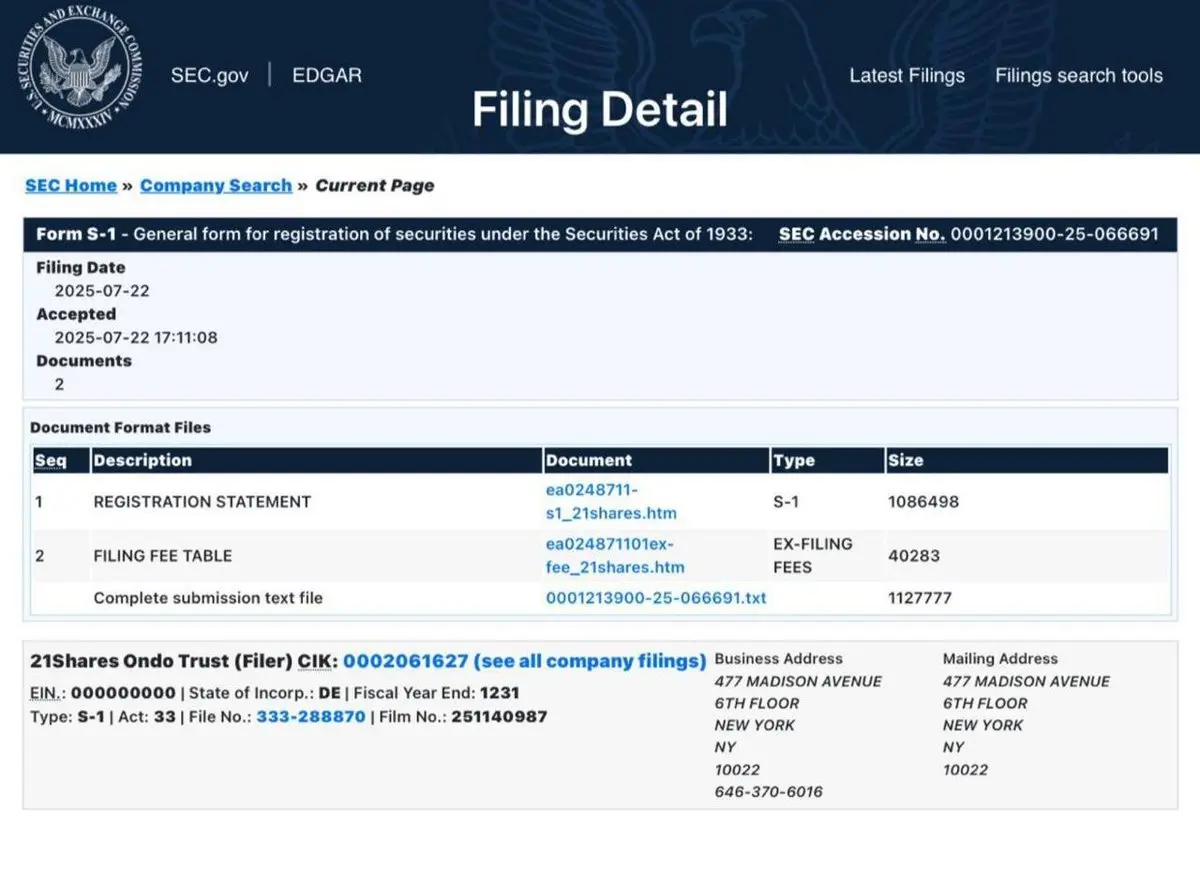

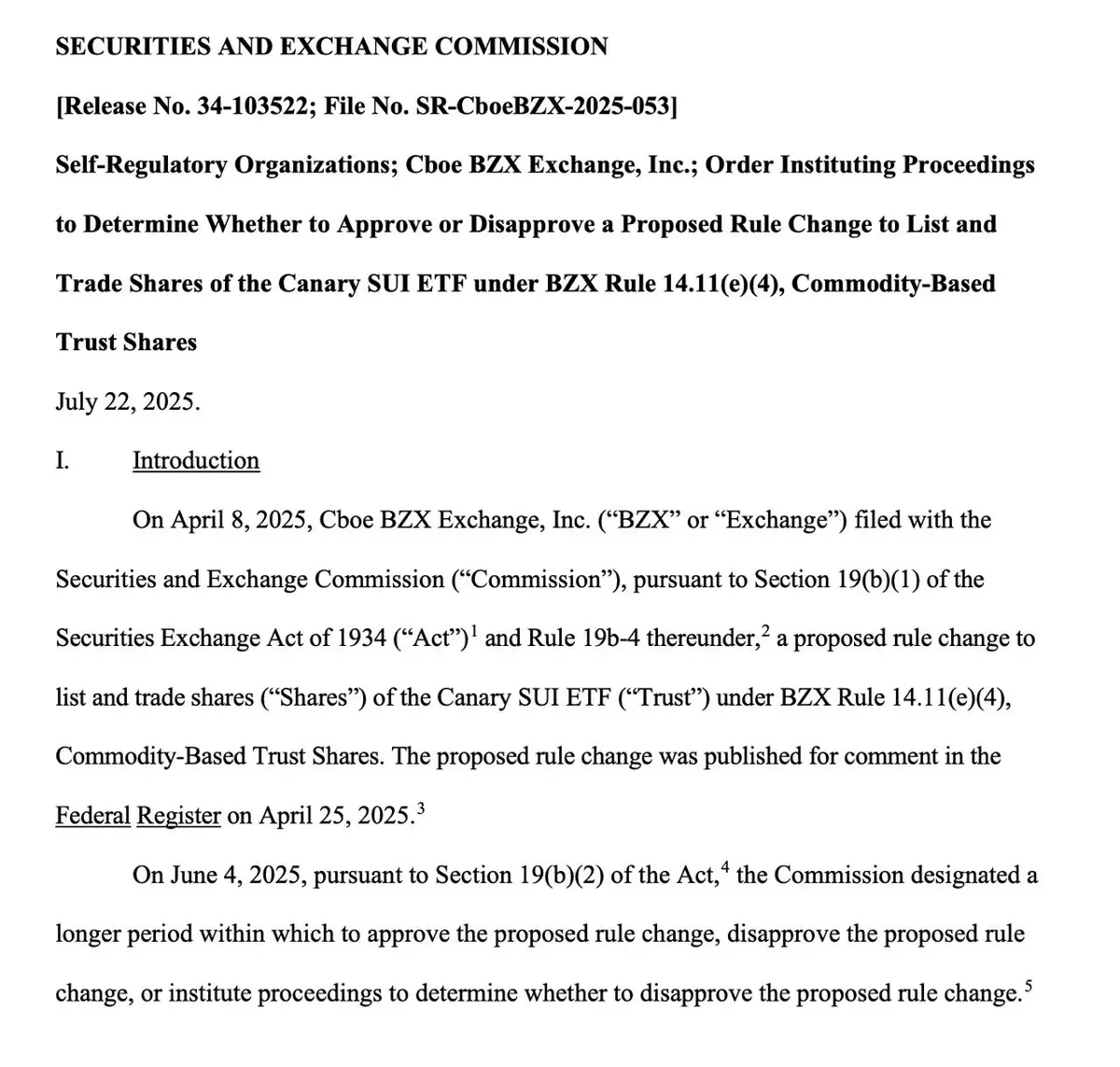

看到不仅仅是一份而是两份现货SUI ETF的申请(Canary + 21Shares)在证券交易委员会(SEC)通过,这是一个大事件。

这不仅仅是另一个替代币炒作周期——这是一个信号,表明真正的基础设施代币正在走入受监管的聚光灯下。

SUI快速、可扩展,并且实际上被使用。

ETF的上市将使其在传统资本眼中合法化——并为其他不叫BTC或ETH的L1打开大门。

我们正在关注加密ETF演变的下一个章节:

不仅仅是价值储存。不仅仅是DeFi蓝筹。

现在是高性能的第一层区块链,正在走向机构化。

#SUI # ETF #CryptoFinance # Layer1 #SEC # 数字资产 #TradFiMeetsDeFi # 市场结构

查看原文这不仅仅是另一个替代币炒作周期——这是一个信号,表明真正的基础设施代币正在走入受监管的聚光灯下。

SUI快速、可扩展,并且实际上被使用。

ETF的上市将使其在传统资本眼中合法化——并为其他不叫BTC或ETH的L1打开大门。

我们正在关注加密ETF演变的下一个章节:

不仅仅是价值储存。不仅仅是DeFi蓝筹。

现在是高性能的第一层区块链,正在走向机构化。

#SUI # ETF #CryptoFinance # Layer1 #SEC # 数字资产 #TradFiMeetsDeFi # 市场结构

- 赞赏

- 点赞

- 评论

- 分享

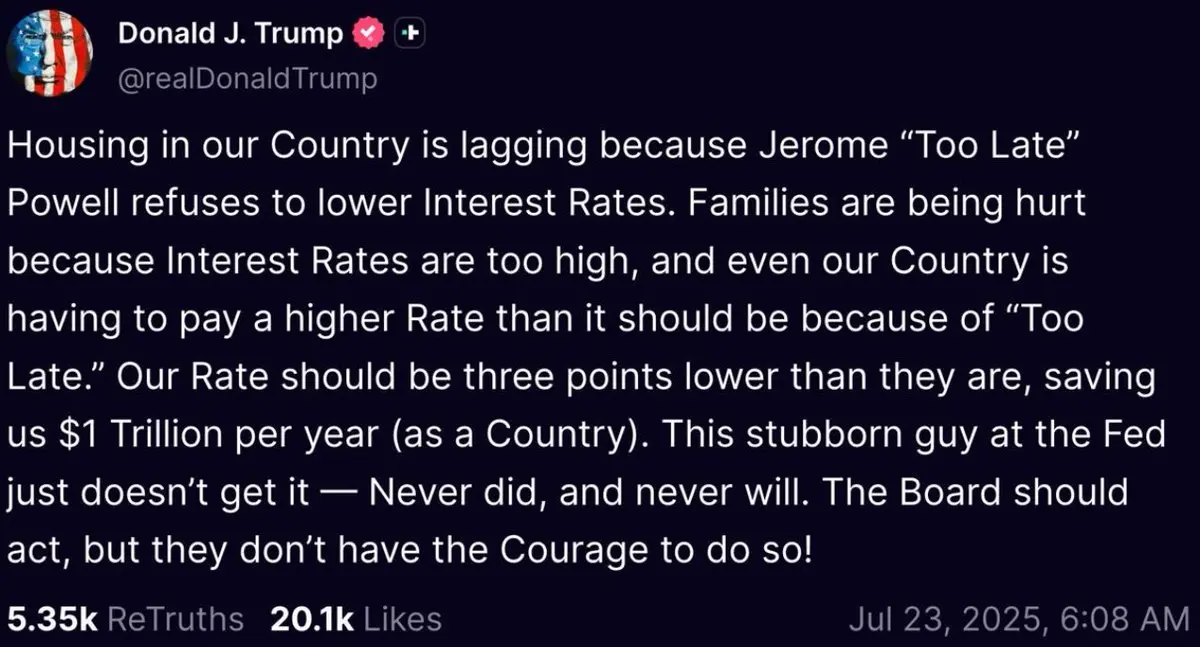

特朗普明天访问美联储并不是...正常的。

我们已经快20年没有看到现任美国总统像这样走进中央银行了。这不仅仅是一次友好的拜访——在经历了几周的公众压力要求降息之后,这次访问才发生。

鲍威尔已经被称为“太晚了”和“历史上最糟糕的美联储主席”。现在总统一直出现在他的家门口。

这模糊了货币政策与政治之间的界限——这很危险。市场需要独立性和可信度,而不是拍照机会和恐吓。

老实说?这就是让比特币固定政策看起来更加理智的事情。

#Trump # 美联储 #Powell # 利率 #Bitcoin # 宏观 #Finance # 独立性重要

查看原文我们已经快20年没有看到现任美国总统像这样走进中央银行了。这不仅仅是一次友好的拜访——在经历了几周的公众压力要求降息之后,这次访问才发生。

鲍威尔已经被称为“太晚了”和“历史上最糟糕的美联储主席”。现在总统一直出现在他的家门口。

这模糊了货币政策与政治之间的界限——这很危险。市场需要独立性和可信度,而不是拍照机会和恐吓。

老实说?这就是让比特币固定政策看起来更加理智的事情。

#Trump # 美联储 #Powell # 利率 #Bitcoin # 宏观 #Finance # 独立性重要

- 赞赏

- 1

- 4

- 分享

ybaser :

:

密切关注 🔍查看更多

💬 特朗普又一次痛批鲍威尔——要求美联储将利率削减3%,声称这将“每年为美丽国节省1万亿美元。”

他不仅仅是在批评政策——他正在攻击中央银行独立性的根基。

• 是的,高利率正在给住房和消费信贷带来压力

• 但政治化的利率设定更糟——它侵蚀了对美元的信任

• 如果美联储对政治压力做出反应,美国货币信誉将崩溃

这就是比特币重要的原因。

因为被政治操控的钱最终会失败。

良好的政策必须超越选举周期。

我们不需要“太迟的鲍威尔”或“太快的特朗普”——我们需要理性的市场。

#Fed # 鲍威尔 #Trump # 利率 #HousingCrisis # 比特币 #Macro # 加密视角 #声音货币

查看原文他不仅仅是在批评政策——他正在攻击中央银行独立性的根基。

• 是的,高利率正在给住房和消费信贷带来压力

• 但政治化的利率设定更糟——它侵蚀了对美元的信任

• 如果美联储对政治压力做出反应,美国货币信誉将崩溃

这就是比特币重要的原因。

因为被政治操控的钱最终会失败。

良好的政策必须超越选举周期。

我们不需要“太迟的鲍威尔”或“太快的特朗普”——我们需要理性的市场。

#Fed # 鲍威尔 #Trump # 利率 #HousingCrisis # 比特币 #Macro # 加密视角 #声音货币

- 赞赏

- 点赞

- 评论

- 分享

🚨 特斯拉刚刚发布了连续第二个季度的收入未达预期——汽车销售同比下降16%。

但他们没有做的是:出售他们的11,509个比特币中的任何一个satoshi。🧊

虽然电动车业务遇挫,他们的比特币库藏保持不变——现在价值约为13亿美元。

• BTC不再仅仅是对冲工具——它已成为核心储备策略

• 特斯拉的定罪与仍持有大量法币资产负债表的科技同行形成对比

• 在通货膨胀和不确定的宏观环境中,数字储备的韧性优于收益

特斯拉可能在利润和政治上面临困境——但它对比特币的投资正在悄然获利。

传统收入是周期性的。数字硬资产则不是。

#Tesla # 比特币 #BTC # 加密国库 #MacroFinance # 马斯克 #DigitalAssets # 电动车市场 #Q2Earnings # 策略转变

查看原文但他们没有做的是:出售他们的11,509个比特币中的任何一个satoshi。🧊

虽然电动车业务遇挫,他们的比特币库藏保持不变——现在价值约为13亿美元。

• BTC不再仅仅是对冲工具——它已成为核心储备策略

• 特斯拉的定罪与仍持有大量法币资产负债表的科技同行形成对比

• 在通货膨胀和不确定的宏观环境中,数字储备的韧性优于收益

特斯拉可能在利润和政治上面临困境——但它对比特币的投资正在悄然获利。

传统收入是周期性的。数字硬资产则不是。

#Tesla # 比特币 #BTC # 加密国库 #MacroFinance # 马斯克 #DigitalAssets # 电动车市场 #Q2Earnings # 策略转变

- 赞赏

- 1

- 1

- 分享

ProTrader00 :

:

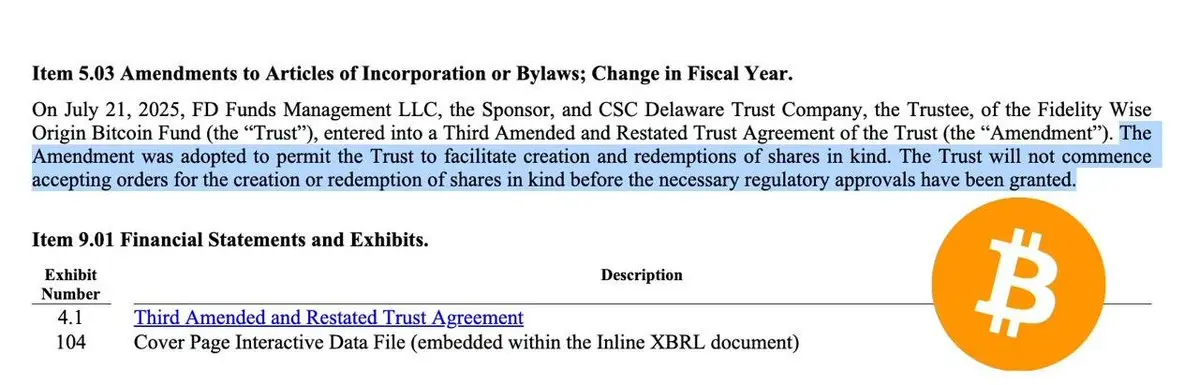

特斯拉死拿BTC强劲,展示出超越短线损失的长线愿景。🚨 BTC & 姨太 ETF 的实物创作/赎回转变是巨大的。

不是因为它华丽——而是因为它是基础设施。

富达、VanEck、Galaxy、21Shares……他们不仅仅是在押注加密货币——他们正在围绕它构建。

🧠 这就是为什么这很重要:

• “实物”指的是由实际加密货币支持的ETF,而不仅仅是现金

• 它更快、更便宜、更具税收效率——黄金ETF模型

• 它消除了机构进入数字资产的摩擦

SEC不再抵抗了——它在优化。

这是一种不会成为头条新闻的进展…

直到它悄然解锁数十亿的新资本。

#Bitcoin # Ethereum #ETF # InKind #SEC # CryptoInfrastructure #TradFiMeetsDeFi # DigitalAssets #InstitutionalAdoption

查看原文不是因为它华丽——而是因为它是基础设施。

富达、VanEck、Galaxy、21Shares……他们不仅仅是在押注加密货币——他们正在围绕它构建。

🧠 这就是为什么这很重要:

• “实物”指的是由实际加密货币支持的ETF,而不仅仅是现金

• 它更快、更便宜、更具税收效率——黄金ETF模型

• 它消除了机构进入数字资产的摩擦

SEC不再抵抗了——它在优化。

这是一种不会成为头条新闻的进展…

直到它悄然解锁数十亿的新资本。

#Bitcoin # Ethereum #ETF # InKind #SEC # CryptoInfrastructure #TradFiMeetsDeFi # DigitalAssets #InstitutionalAdoption

- 赞赏

- 点赞

- 评论

- 分享

- 赞赏

- 点赞

- 评论

- 分享

- 赞赏

- 点赞

- 评论

- 分享

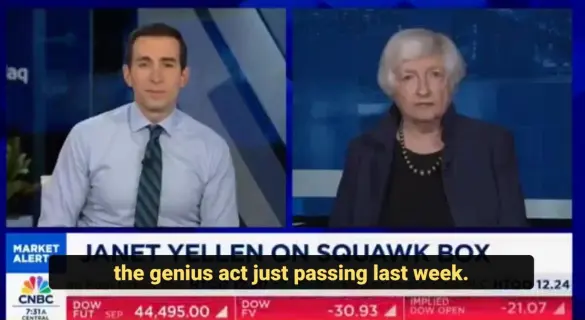

💬 耶伦是对的 — 也是错的。

是的,稳定币需要监管。

是的,如果不加以控制,它们可能会带来风险。

但是GENIUS法案并不是终点——它是现代货币基础设施的开始。

传统系统感到担忧——不是因为加密货币弱,而是因为它变得可信。

稳定币不再是边缘化的存在。

它们是结算轨道。它们是可编程的美元。

他们的扩展速度超过了历史上任何支付技术。

如果耶伦想要安全——她应该倡导链上透明度、实时审计和明确的联邦标准,而不是恐惧驱动的把关。

我们正在构建一个新的金融层。让我们负责任地去做——但不要放慢速度。

#Stablecoins # 天才法案 #CryptoRegulation # 数字美元 #Web3 # 金融的未来 #Macro # 中央银行数字货币

查看原文是的,稳定币需要监管。

是的,如果不加以控制,它们可能会带来风险。

但是GENIUS法案并不是终点——它是现代货币基础设施的开始。

传统系统感到担忧——不是因为加密货币弱,而是因为它变得可信。

稳定币不再是边缘化的存在。

它们是结算轨道。它们是可编程的美元。

他们的扩展速度超过了历史上任何支付技术。

如果耶伦想要安全——她应该倡导链上透明度、实时审计和明确的联邦标准,而不是恐惧驱动的把关。

我们正在构建一个新的金融层。让我们负责任地去做——但不要放慢速度。

#Stablecoins # 天才法案 #CryptoRegulation # 数字美元 #Web3 # 金融的未来 #Macro # 中央银行数字货币

- 赞赏

- 点赞

- 评论

- 分享

🇺🇸🤝🇯🇵 突发:特朗普宣布与日本达成历史性贸易协议——日本对美国投资5500亿美金,美国将获得90%的收益。市场轰动。🚀

🔹 日本将投资5500亿美元于美丽国——特朗普称这“可能是历史上最大的交易”

🔹 对日本出口的互惠关税为15% — 低于之前威胁的25%

🔹 日本向美丽国开放汽车、卡车、大米、农业及液化天然气市场 (来自阿拉斯加的联合出口企业)

🔹 预计将创造数十万个美丽国工作岗位

这超越了典型的贸易协定——这是一项战略投资和工业重置。

🇺🇸 大规模资本流入:5500亿美元的注入可能会加速美丽国的基础设施、能源和科技生态系统

🚗 自动、农业、能源行业解锁——美国出口终于获得更大程度地进入日本庞大市场的机会

🔄 关税妥协增强了可预测性——15%的互惠税率降低了风险,同时锁定了收益

🏗️ 工作与增长叙事回归——在特朗普贸易议程8月截止日期之前的理想时机

#TradeDeal # 美丽国日本 #Trump # 全球金融 #TradePolicy # 经济战略 #CapitalFlows # 宏观

查看原文🔹 日本将投资5500亿美元于美丽国——特朗普称这“可能是历史上最大的交易”

🔹 对日本出口的互惠关税为15% — 低于之前威胁的25%

🔹 日本向美丽国开放汽车、卡车、大米、农业及液化天然气市场 (来自阿拉斯加的联合出口企业)

🔹 预计将创造数十万个美丽国工作岗位

这超越了典型的贸易协定——这是一项战略投资和工业重置。

🇺🇸 大规模资本流入:5500亿美元的注入可能会加速美丽国的基础设施、能源和科技生态系统

🚗 自动、农业、能源行业解锁——美国出口终于获得更大程度地进入日本庞大市场的机会

🔄 关税妥协增强了可预测性——15%的互惠税率降低了风险,同时锁定了收益

🏗️ 工作与增长叙事回归——在特朗普贸易议程8月截止日期之前的理想时机

#TradeDeal # 美丽国日本 #Trump # 全球金融 #TradePolicy # 经济战略 #CapitalFlows # 宏观

- 赞赏

- 点赞

- 评论

- 分享

🚨 突发消息:JPMorgan将推出以BTC和姨太作为抵押的加密货币贷款。

管理资产$4.3T。全球最具系统重要性的银行之一。现在正在验证数字资产……作为硬通货。🧱

这不是零售炒作。

这就是传统金融在其最纯粹的形式中利用加密货币——抵押品。

当摩根大通将比特币作为抵押时,信息很明确:

数字资产是基础层资本。

超级看涨并不是夸大其词——这是现实。

#Bitcoin # 姨太 #JPMorgan # CryptoCollateral #TradFiMeetsDeFi # 数字资产 #看涨势头

查看原文管理资产$4.3T。全球最具系统重要性的银行之一。现在正在验证数字资产……作为硬通货。🧱

这不是零售炒作。

这就是传统金融在其最纯粹的形式中利用加密货币——抵押品。

当摩根大通将比特币作为抵押时,信息很明确:

数字资产是基础层资本。

超级看涨并不是夸大其词——这是现实。

#Bitcoin # 姨太 #JPMorgan # CryptoCollateral #TradFiMeetsDeFi # 数字资产 #看涨势头

- 赞赏

- 点赞

- 评论

- 分享

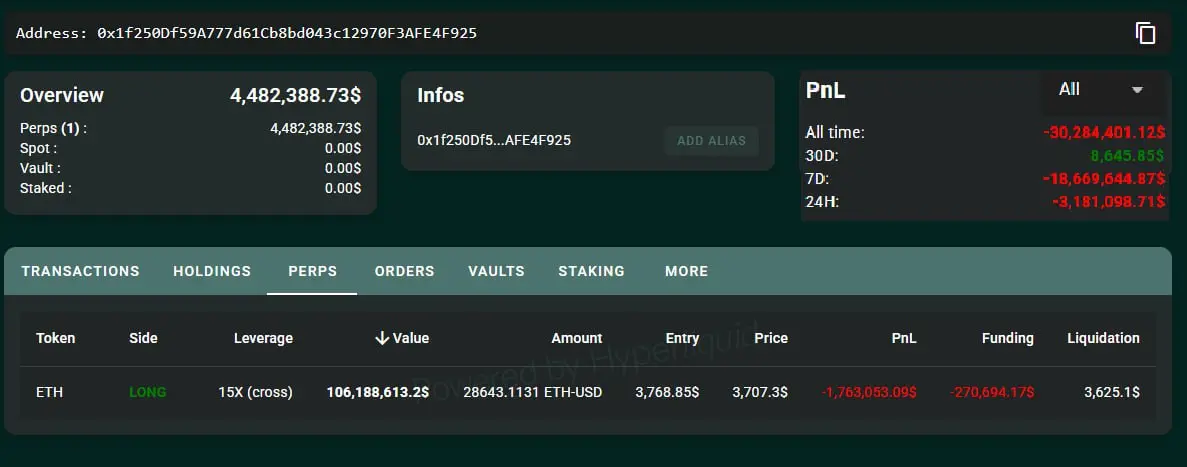

🔥 一只鲸鱼刚刚被清算超过2600万美元!

Aguila Trades 在一个 15 倍杠杆的多头 ETH 头寸上部分清算,损失约 7,160 ETH (~$26.17 million)。

清算价格:$3,650

#CryptoLiquidation # 鲸鱼警报 #ETHCrash # 加密新闻

Aguila Trades 在一个 15 倍杠杆的多头 ETH 头寸上部分清算,损失约 7,160 ETH (~$26.17 million)。

清算价格:$3,650

#CryptoLiquidation # 鲸鱼警报 #ETHCrash # 加密新闻

ETH1.73%

- 赞赏

- 点赞

- 评论

- 分享

- 赞赏

- 点赞

- 评论

- 分享

🚨 Strategy 正在通过优先股筹集500M,以购买更多比特币。(STRC)

是的,又来了。但这次是以收益为支撑,并由机构承销的。

🔹 每股100美元,目标总额5亿美元

🔹 9% 年现金分红,可根据短期利率调整

🔹 可通过策略以 $101 + 未支付的股息调用

🔹 看跌期权:如果发生重大变化,投资者可以要求回购

🔹 获得摩根士丹利、巴克莱、摩利斯公司和TD证券的支持

这不仅仅是另一个看涨的头条——这是比特币积累的资产负债表工程。

• 现金流 + 收益 + 比特币 = 一个强大的三重奏

• 他们正在围绕比特币构建一个完整的资本结构

• 传统金融银行现在共同签署比特币结构性敞口

MicroStrategy走过的路,使得Strategy能够进行结构化。

#Bitcoin # 策略 #STRC # 机构加密 #YieldFinance # 传统金融与去中心化金融 #加密资产库

查看原文是的,又来了。但这次是以收益为支撑,并由机构承销的。

🔹 每股100美元,目标总额5亿美元

🔹 9% 年现金分红,可根据短期利率调整

🔹 可通过策略以 $101 + 未支付的股息调用

🔹 看跌期权:如果发生重大变化,投资者可以要求回购

🔹 获得摩根士丹利、巴克莱、摩利斯公司和TD证券的支持

这不仅仅是另一个看涨的头条——这是比特币积累的资产负债表工程。

• 现金流 + 收益 + 比特币 = 一个强大的三重奏

• 他们正在围绕比特币构建一个完整的资本结构

• 传统金融银行现在共同签署比特币结构性敞口

MicroStrategy走过的路,使得Strategy能够进行结构化。

#Bitcoin # 策略 #STRC # 机构加密 #YieldFinance # 传统金融与去中心化金融 #加密资产库

- 赞赏

- 点赞

- 评论

- 分享

🇺🇸 白宫本月将发布首份特朗普时代的加密政策报告。🚀

在加密顾问David Sacks和政策主任Bo Hines的领导下,该框架标志着特朗普执政下的首次重大加密政策努力——在GENIUS法案之后。📘

关键优先事项可能包括:

+ 🇺🇸 战略比特币储备 ( 和可能的美国BTC收购)

+ 建立国家数字资产储备

+ 扩大对加密公司的银行接入,特别是通过美联储

+ 新协议应对反洗钱、规避制裁和国家安全风险

这直接建立在特朗普1月份的行政命令基础上,并利用GENIUS稳定币法案的势头。

与此同时,国会继续前进:

+ 参议院银行委员会正在起草 CLARITY 法案 (市场结构)

+ 参议院农业委员会今天对布赖恩·昆滕茨担任CFTC主席进行投票。

这不是公关噱头——这是政策的转折点。首次,数字货币正在塑造美国国家战略,而不仅仅是金融科技。基础设施与地缘政治相结合:链上资产在公共储备中、银行接入以及受监管的数字主权。

如果执行,报告可能会:

+ 将BTC视为战略国家资产

+ 解锁数字金融公司的美联储级别访问权限

准备好还没准备好,加密政策刚刚变得战略性。

#CryptoPolicy # 战略储备 #DavidSacks # BoHines #GENIUSAct # 清晰法案 #CryptoRegulation # 数字资产

查看原文在加密顾问David Sacks和政策主任Bo Hines的领导下,该框架标志着特朗普执政下的首次重大加密政策努力——在GENIUS法案之后。📘

关键优先事项可能包括:

+ 🇺🇸 战略比特币储备 ( 和可能的美国BTC收购)

+ 建立国家数字资产储备

+ 扩大对加密公司的银行接入,特别是通过美联储

+ 新协议应对反洗钱、规避制裁和国家安全风险

这直接建立在特朗普1月份的行政命令基础上,并利用GENIUS稳定币法案的势头。

与此同时,国会继续前进:

+ 参议院银行委员会正在起草 CLARITY 法案 (市场结构)

+ 参议院农业委员会今天对布赖恩·昆滕茨担任CFTC主席进行投票。

这不是公关噱头——这是政策的转折点。首次,数字货币正在塑造美国国家战略,而不仅仅是金融科技。基础设施与地缘政治相结合:链上资产在公共储备中、银行接入以及受监管的数字主权。

如果执行,报告可能会:

+ 将BTC视为战略国家资产

+ 解锁数字金融公司的美联储级别访问权限

准备好还没准备好,加密政策刚刚变得战略性。

#CryptoPolicy # 战略储备 #DavidSacks # BoHines #GENIUSAct # 清晰法案 #CryptoRegulation # 数字资产

- 赞赏

- 1

- 评论

- 分享

➡️ 本周,鲍威尔主席将发表重要演讲,宣布时可能引发显著的市场波动。请谨慎使用杠杆。

⭕️ 截至目前,根据CME(,联邦储备委员会在7月31日降息的概率为:

+ 无变化: 93.6%

+ 25bps降息:6.4%

>> 来源:

⭕️ 截至目前,根据CME(,联邦储备委员会在7月31日降息的概率为:

+ 无变化: 93.6%

+ 25bps降息:6.4%

>> 来源:

MAY-3.05%

- 赞赏

- 点赞

- 评论

- 分享