Will Digital Currencies Replace Cash? A Comprehensive Analysis of Future Financial Trends

What Is Digital Currency?

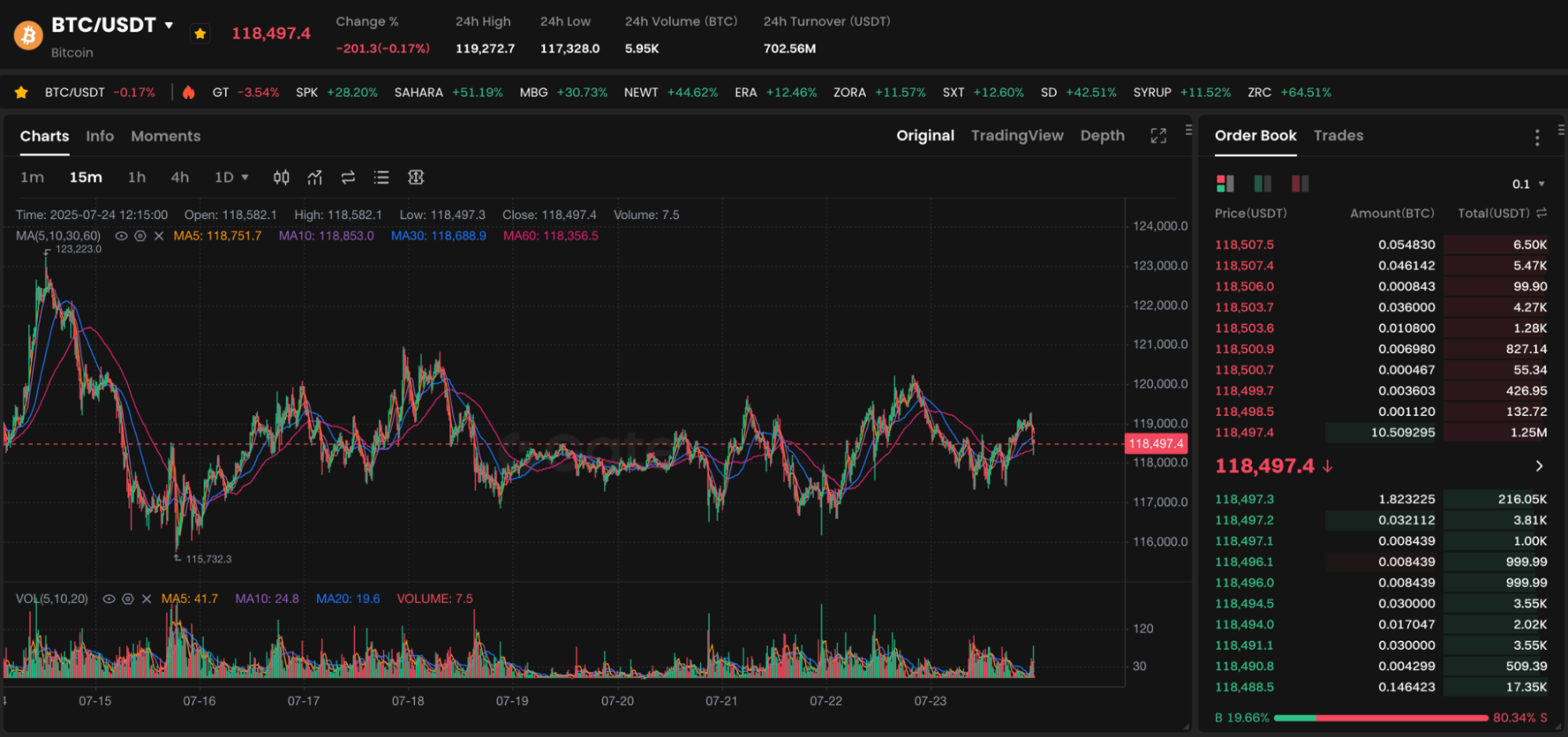

Image: https://www.gate.com/trade/BTC_USDT

Digital currency is a type of money that exists solely in digital form and does not use a physical medium for issuance. It encompasses both decentralized cryptocurrencies (such as Bitcoin and Ethereum) and central bank digital currencies (CBDCs) issued by national authorities (like China’s digital yuan or the European digital euro). Unlike traditional cash, digital currencies are powered by blockchain or database technologies and have no tangible counterpart.

Advantages and Development of Digital Currency

Digital currency has attracted widespread attention for several key reasons:

- High Efficiency: Digital currency eliminates the need for physical printing and distribution, enabling almost instant transfers.

- Lower Costs: It significantly reduces expenses related to physical currency production, transportation, and counterfeiting prevention.

- Regulatory Oversight: Digital transactions are traceable, supporting anti-money laundering and anti-corruption initiatives.

- Globalization: Cryptocurrencies are especially effective for cross-border payments, allowing users to bypass traditional banking systems.

To date, over 130 countries are actively researching or piloting central bank digital currencies. For instance, China’s digital yuan has already seen real-world adoption and is used in retail, transportation, and other sectors.

The Role of Cash in Modern Society

Despite the rapid rise of digital currency, cash continues to serve several irreplaceable functions:

- Privacy Protection: Physical cash transactions are much harder to track, offering greater personal privacy.

- Financial Inclusion: Cash does not require access to a smartphone or the internet, making it more accessible for older adults and people living in rural or underserved areas.

- Emergency Readiness: In cases of network or power outages, cash remains a functional means of payment.

During major disruptions such as natural disasters or cyberattacks, cash still serves as a reliable backup payment method.

Will Digital Currency Completely Replace Cash?

Although digital currency is reducing the reliance on cash, it is unlikely to fully replace it any time soon. The main obstacles include:

- Technological Barriers: Digital currency depends on smartphones and internet connectivity, which remain out of reach for many people in developing regions.

- Policy Considerations: Governments may choose to retain cash due to concerns over privacy, control, and control over monetary policy.

- Habits and Accessibility: Older adults and people unfamiliar with technology continue to rely on cash for everyday transactions.

For the foreseeable future, cash and digital currency will coexist. People will favor digital currency for frequent, small-value, and urban transactions. Cash will continue to serve critical functions in emergencies and transitional scenarios.

Challenges and Future Trends

For digital currency to fully replace cash, it must overcome several challenges:

- Unequal Access to Technology: Broader adoption of smartphones and improved network infrastructure are necessary.

- Regulatory Gaps: In the cryptocurrency sector, divergent regulatory approaches across jurisdictions create uncertainty.

- User Education: The public needs greater awareness and understanding of digital asset security and practical use.

As technology continues to progress and regulatory frameworks become more robust, digital currency’s role will steadily increase. However, completely replacing cash is likely to take more than a decade.