Ethereum Price Prediction: Corporate Accumulation Pushes ETH Toward $4,400 Target

Is ETH Poised for a Breakout?

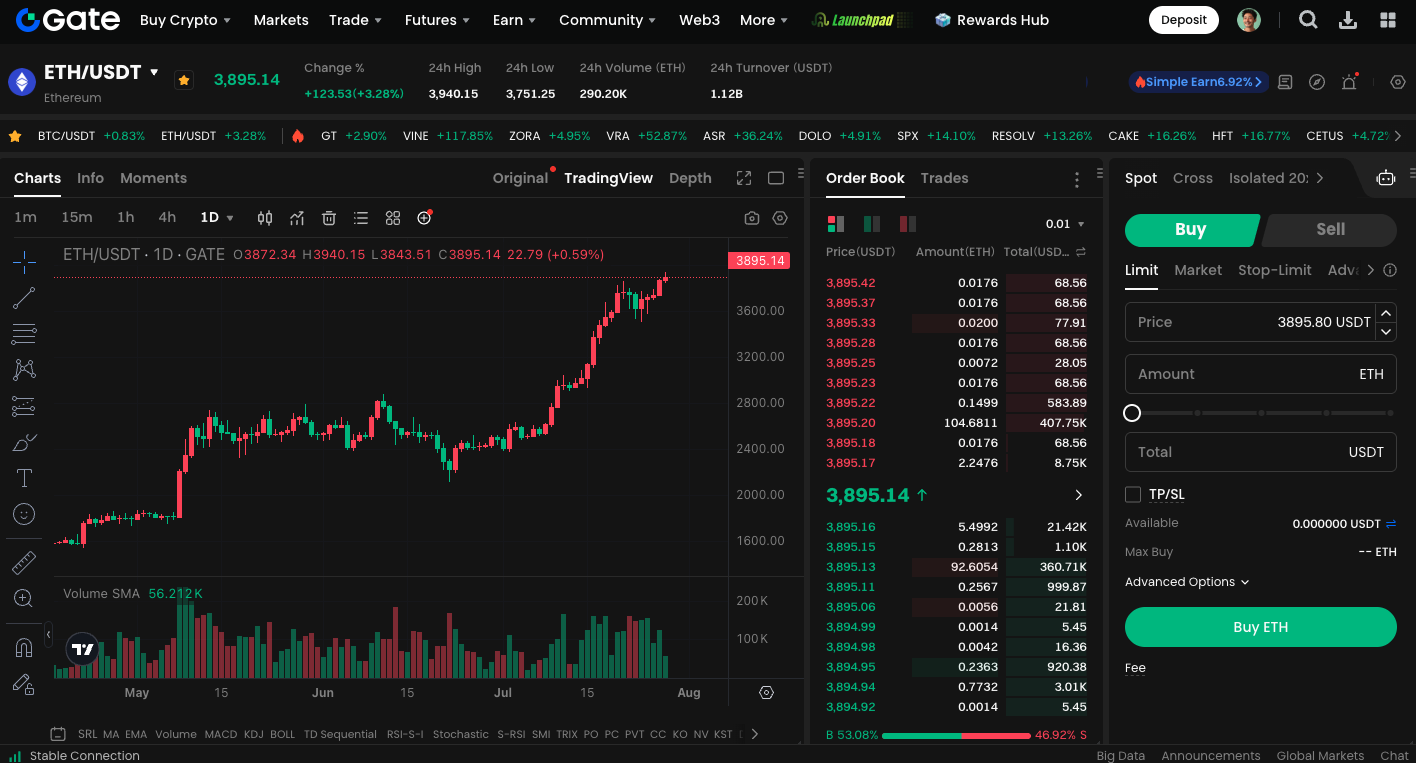

Ethereum (ETH) has recently consolidated just below a critical resistance level, with both technical and fundamental signals pointing to a potential upside move. If ETH can decisively break through the $4,100 resistance, it could trigger another rally and approach the $4,400 level.

Long-Term Structure Supports Bullish Momentum

The daily chart for ETH indicates a strong bullish trend. The previous resistance zone at $3,500 has now flipped to solid support. The 100-day and 200-day moving averages have formed a golden cross, a bullish technical pattern. While the RSI briefly entered overbought territory, it has moderated somewhat but remains elevated, reflecting ongoing buying interest and optimism for ETH’s upside.

If ETH maintains a position above $3,800 in the near term, it will provide further potential for price appreciation. However, if it drops below this level, a pullback toward $3,500 would still represent a healthy correction.

On-Chain Data Shows Accelerating Inflows

Open interest in ETH across major exchanges has surged to $27 billion, marking a multi-year high and indicating a surge in leveraged trading activity. Funding rates remain neutral, suggesting that bullish positions are not excessively crowded and the market is not overheated. This equilibrium provides ETH with further upside potential, reducing the likelihood of rapid corrections due to short-term technical factors.

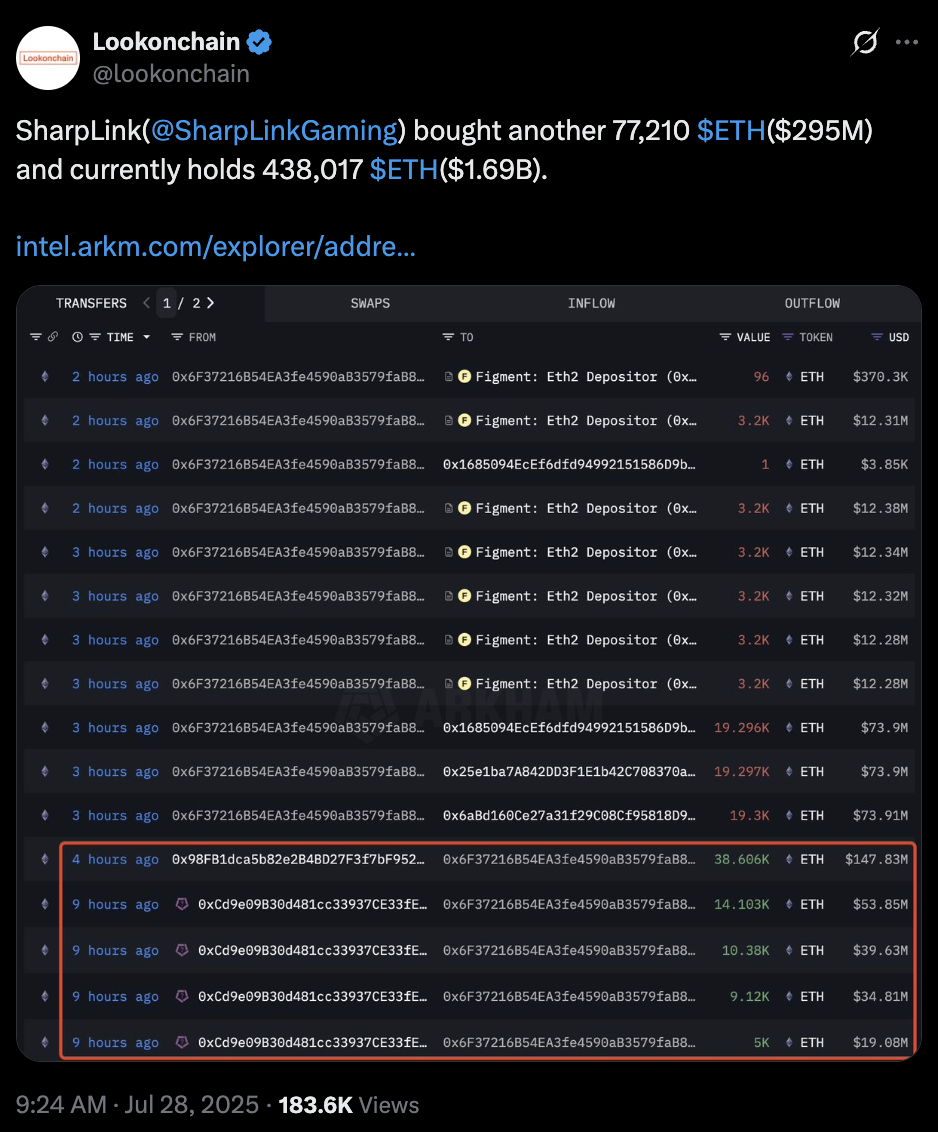

Institutions Are Buying ETH Aggressively

SharpLink Gaming recently boosted its ETH holdings by more than 77,000 ETH, worth about $295 million, bringing its total to over 438,000 ETH valued at more than $1.69 billion. This positions SharpLink as the second-largest corporate holder of ETH, second only to BitMine.

(Source: lookonchain)

This purchase alone exceeds Ethereum’s total net issuance over the past 30 days, exerting substantial supply-side pressure. If other institutions follow, ETH prices could increase even further as the supply squeeze intensifies.

Start trading ETH spot now: https://www.gate.com/trade/ETH_USDT

Summary

Ethereum is currently in an upward phase, with price movement and market sentiment mutually reinforcing. If capital inflows continue and technical strength holds, a breakout to $4,400 may be achievable. In the short term, key factors to watch include:

- Whether ETH maintains critical support above $3,800

- Whether leverage trends change in the spot and futures markets

- Whether institutions continue to enter the market and absorb supply

A successful breakout above $4,100 could signal the start of new bull market highs.