Ethena Explained: Synthetic Dollar USDe and the Future of Web3 Stablecoins

What is Ethena?

Ethena is a decentralized finance (DeFi) protocol built on the Ethereum blockchain. Its core innovation is USDe, a synthetic dollar stablecoin that isn’t backed by fiat but instead maintains its US dollar peg via a delta-hedging strategy utilizing crypto assets and derivatives. Ethena also offers sUSDe, a yield-generating dollar-denominated deposit tool that combines stability with passive income potential.

How Ethena Works: Core Mechanisms

- USDe: Synthetic Dollar Mechanics

USDe employs a delta-hedging strategy, using assets like Bitcoin, Ethereum, and Solana as collateral while simultaneously taking offsetting positions in perpetual or futures contracts. This approach stabilizes value and generates yield. USDe also leverages a mint-redeem arbitrage mechanism to help maintain its peg. - sUSDe: The Internet Bond Savings Tool

Ethena introduces the concept of an Internet Bond, combining staking rewards and futures basis income to create an opportunity to earn yield in US dollars for liquidity providers.

Ethena’s Competitive Edge

Ethena’s main strength is its creation of a truly crypto-native dollar stablecoin. USDe operates independently of centralized entities, relying solely on transparent, on-chain assets and derivative-based hedging for stability. Meanwhile, sUSDe delivers compelling passive returns. With rapid growth in total value locked (TVL) and expanding partnerships, Ethena is building a highly promising DeFi stablecoin ecosystem.

2025 Outlook

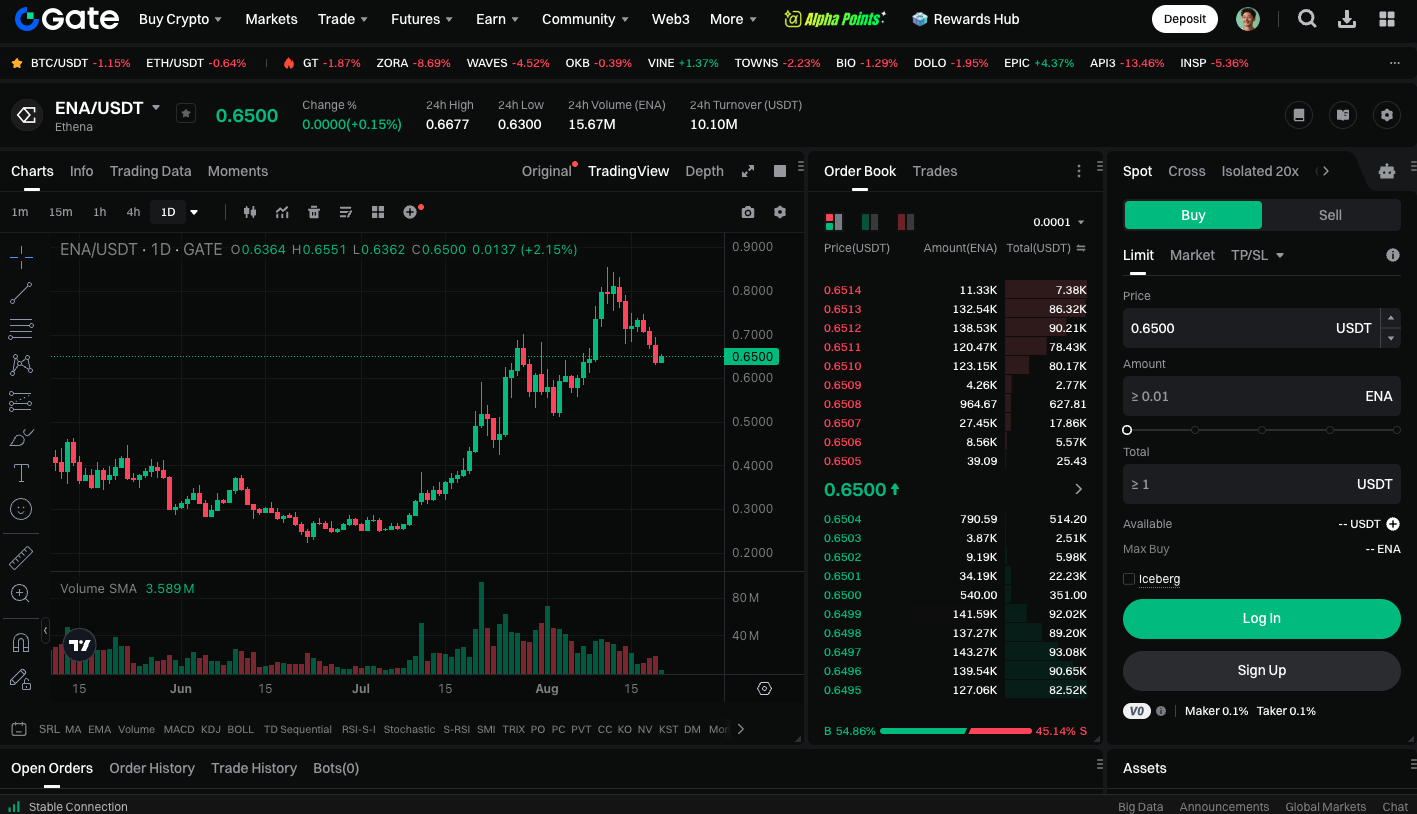

- Market Price and Sentiment

ENA has shown strong recent performance, with a spot price above $0.65 at the time of writing. The market is focused on whether it can break through the $1.40 resistance level. - Rising Stablecoin Status

USDe has climbed to the world’s third-largest stablecoin by market cap, with its total value locked (TVL) exceeding $10 billion—shows the ecosystem’s scale and growing acceptance. - Compliance and Institutional Partnerships

Ethena has partnered with Anchorage Digital to issue the compliant stablecoin USDtb on a regulated platform, integrating with the traditional financial system and boosting Ethena Protocol’s credibility and institutional trust.

Challenges and Risks

Ethena faces notable risks. USDe’s high yields, which once reached 60%, have fallen below 5%, reflecting declining arbitrage opportunities. If perpetual contract funding rates turn negative, the delta-hedging model could break down. This would risk the stability of the stablecoin. Since part of Ethena’s liquidity is derived from liquid staking tokens (LSTs), any depegging events there could also expose the protocol to risk.

Future Trends

Looking ahead, Ethena plans to deepen institutional partnerships and strengthen its regulatory position. For example, leveraging Anchorage Digital’s platform to introduce USDtb to traditional financial infrastructure could drive higher trust and adoption. As a decentralized dollar alternative, USDe has the potential to become a major player in the DeFi stablecoin arena, particularly in the yield-bearing sector. If Ethena maintains stability and achieves wide adoption across CeFi and Web3, it could set a new standard for secure and appealing digital currency infrastructure.

ENA/USDT Spot Trading

ENA is gaining traction among younger investors in the spot market. Paired with USDT, ENA enables users to capture value. It also offers arbitrage opportunities within the Ethena ecosystem. Spot trading offers flexible entry and exit points. It also allows easy participation in governance and liquidity provision.

You can start trading ENA spot now: https://www.gate.com/trade/ENA_USDT

Summary

Ethena brings a new, crypto-native perspective to the stablecoin market with its innovative pricing and yield models. USDe and sUSDe are designed to meet the needs of DeFi and Web3 investors, while offering a different approach to digital money. Although arbitrage and strategy risks remain, Ethena’s ongoing progress with compliance and transparency could drive robust growth after 2025, establishing itself as a key player in the DeFi stablecoin sector.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025