BTC Staking Gains Popularity Again: How to Achieve Steady Growth in the New Bull Market Phase

BTC Reaches New All-Time High, Market Enters Consolidation Phase

Chart: https://www.gate.com/trade/BTC_USDT

In July 2025, Bitcoin (BTC) surpassed its previous records and reached a new all-time high of $123,223, exceeding bullish expectations that had built up over several years. A series of favorable U.S. policy announcements during “Crypto Week” and substantial institutional inflows into Bitcoin ETFs fueled this momentum. Subsequently, the price retraced to around $117,000, marking the beginning of a consolidation phase at high levels. Traders now face a key decision: continue holding for potential further gains, or attempt to realize profits while accepting higher volatility risk.

During this period, BTC staking has gained attention as a lower-risk method for generating stable returns.

Strategies in a Consolidating Market: The Emergence of BTC Staking

Staking enables users to allocate their BTC on a platform, which utilizes these assets for on-chain activities such as lending or liquidity provision. The platform then distributes regular interest payments to users.

Compared to frequent trading or holding idle assets in a wallet, staking BTC offers consistent returns. This approach is particularly suitable during bull market consolidation phases as an effective passive investment strategy.

Five Advantages of BTC Staking

- Stable returns: BTC staking currently offers an annualized yield of approximately 3.03% without direct exposure to market price fluctuations.

- Preserve your position: Earn yield without selling BTC, allowing participation in future price appreciation and reducing the risk of losses from premature liquidation.

- Flexible terms: Access on-demand deposits and redemptions, maintaining overall liquidity of your funds.

- Low technical barrier: The process is straightforward, enabling even novice users to participate easily.

- Comprehensive platform security: Major exchanges such as Gate provide robust risk management and regulatory compliance.

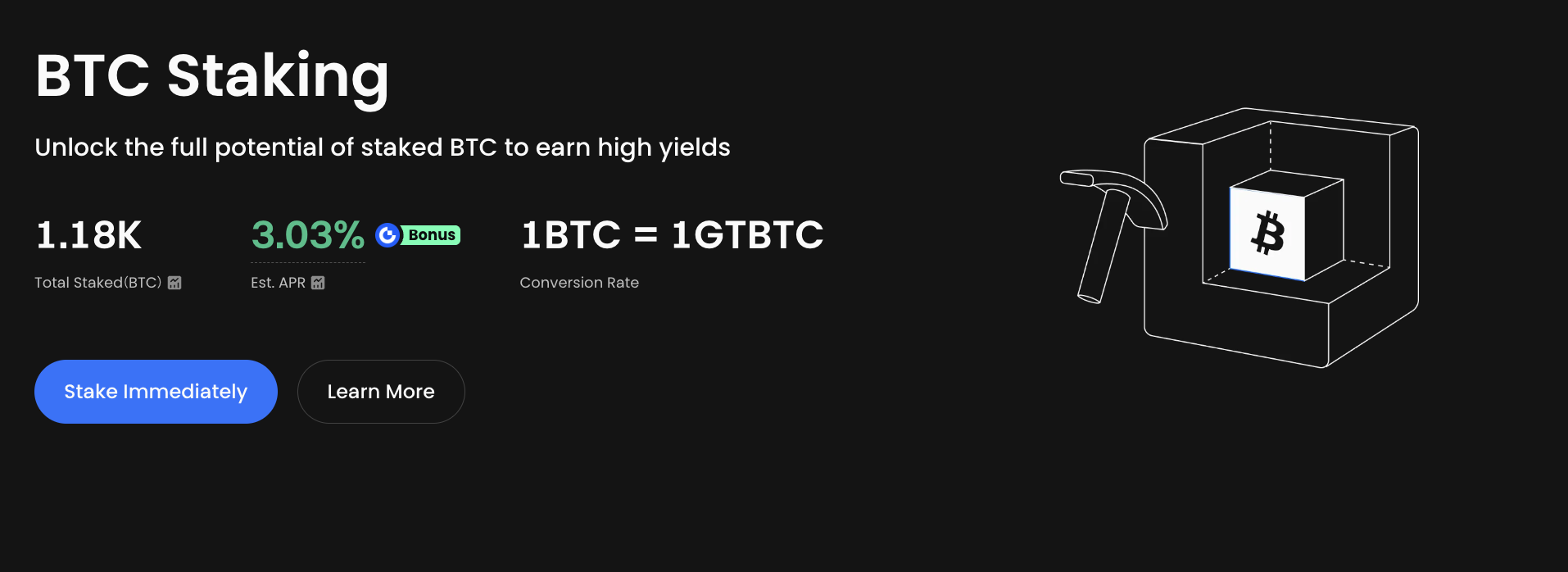

Gate BTC Staking Product Features

Chart: https://www.gate.com/staking/BTC

As a leading global cryptocurrency exchange, Gate offers a BTC staking product recognized for its stable returns and flexible structure:

- Annualized yield of approximately 3.03%, with daily interest calculation and real-time balance updates;

- Low minimum entry—starting from just 0.001 BTC;

- Secure custody of funds with transparent on-chain records provided by the platform;

- Rapid redemption system, allowing users to withdraw principal and interest at any time;

- Support for multiple assets: Alongside BTC, users can stake ETH, USDT, and other major cryptocurrencies.

This solution is well-suited for BTC holders seeking low-risk, stable returns.

Who is BTC Staking Suitable For?

- Long-term BTC holders seeking to generate yield while retaining ownership;

- Investors less inclined toward short-term trading, who want to avoid losses resulting from inaccurate market timing;

- Those aiming to diversify risk by adding another yield-generating avenue beyond spot trading and mining;

- Passive holders who prefer to keep assets stationary, yet wish to earn returns during market uptrends.

Conclusion: “Hold and Earn” as a Prudent Bull Market Strategy

Following its new high, Bitcoin has not yet surpassed the next major resistance level, and the market has entered a widely acknowledged consolidation phase. In this environment, rather than pursuing short-term price movements, staking BTC enables investors to earn steady returns on existing holdings. This approach helps accumulate capital for future market opportunities.

For new users seeking stable growth, the current environment presents favorable conditions for participating in BTC staking. With a 3.03% annualized yield, flexible redemption, and user-friendly operation, Gate’s BTC staking product provides an accessible method for earning yield while holding BTC during a bull market.