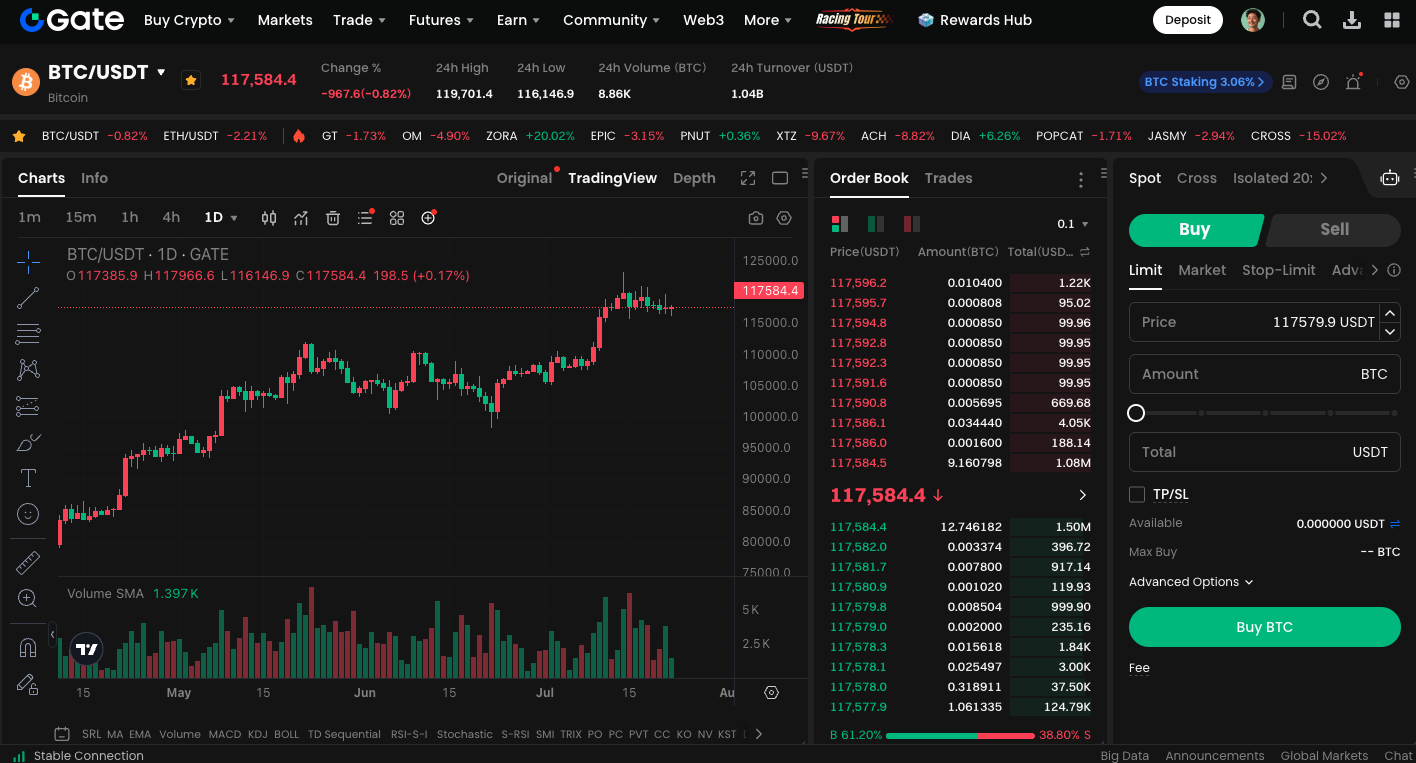

Bitcoin Price Prediction: BTC Bulls Lose Momentum, Eyes on $116,000 as Key Breakdown Level

BTC Fails to Hold $120,000, Enters Short-Term Consolidation Under Selling Pressure

Bitcoin (BTC) is facing persistent headwinds, failing to break above the $120,000 mark and slipping back into a period of volatile consolidation at elevated levels. After a brief rally above $117,000, the overall tone remains weak. This has led to shaken market confidence.

Currently, BTC is trading below its 100-hour simple moving average, with significant resistance overhead. Technically, a descending trendline on the hourly chart is suppressing any rebound attempts.

BTC’s Critical Support Levels

In the near term, if bulls can’t convincingly break through the $118,500 resistance band, another pullback is likely. The first major support lies at $116,000. If this area fails, prices could retest $115,000 or even lower. The most critical support level is at $111,000; a drop below this could sharply worsen market sentiment and trigger a deeper correction.

BTC Price Outlook and Challenges

Despite recent weakness, if BTC can establish a foothold above $119,000, it would generate a clear bullish signal, potentially paving the way for another run at $120,000 or even fresh all-time highs. Such a move could also reinvigorate the broader market and benefit altcoin investors.

To trade BTC spot, visit: https://www.gate.com/trade/BTC_USDT

Summary

In summary, BTC stands at a pivotal point. A strong defense of support levels and a decisive breakout on heavy volume could ignite a new bullish phase. Conversely, a breakdown below $116,000 would heighten short-term risk. Investors should proceed with caution and wait for clearer market direction.