What is Aspecta (ASP)?

Repost of original article: “What Is Aspecta (ASP), the Next Token to Launch on Binance Alpha?”

Originally published on July 11, 2024.

Binance Alpha will list Aspecta (ASP) on July 24, 2024. Eligible users can claim an airdrop on the Alpha event page using Binance Alpha Points once trading begins. On July 10, 2024, Yzi Labs announced a strategic investment in Aspecta. This article provides a concise analysis of Aspecta, which aims to establish on-chain standards and trust mechanisms for illiquid assets in traditional capital markets. The discussion covers project design logic, product structure, development progress, and industry potential.

Team Background

Aspecta benefits from a strong foundation and was not created from scratch. The project was incubated in 2022 at Tsai CITY (Tsai Center for Innovative Thinking at Yale) at Yale University. The core team consists of alumni from top institutions including Yale, Tsinghua University, UC Berkeley, and McGill University, with multiple patents and published research in AI and graph learning. The co-founding team includes Steve Liu, former Chief Scientist at Tinder and Fellow of the Canadian Academy of Engineering, who now serves as Chief Scientist; Jack He as co-founder; and experienced engineers and growth leaders such as Jane Yang.

Co-founder Jack He speaking at TreeHacks

Why Was Aspecta Created? What Problems Does It Address?

In traditional markets, assets such as early-stage equity, locked tokens, private equity, and real-world assets (RWA) are generally not tradable on public markets and lack transparent pricing. This severely limits liquidity and pricing efficiency. Aspecta seeks to bring these “closed assets” on-chain, enabling pricing and tradability, thereby reducing information asymmetry and enhancing asset utilization.

For example, consider a project that locks a portion of its tokens after a Series A round. When the lockup period ends, holders may hesitate to exit due to the absence of liquidity and transparent pricing mechanisms. Aspecta applies a standardized wrapping and trust mechanism, allowing these assets to be priced, traded, and tracked—unlocking new value.

Two Core Products: BuildKey and Aspecta ID

Aspecta’s design consists of two complementary product lines:

BuildKey: Asset Standardization and Lifecycle Pricing

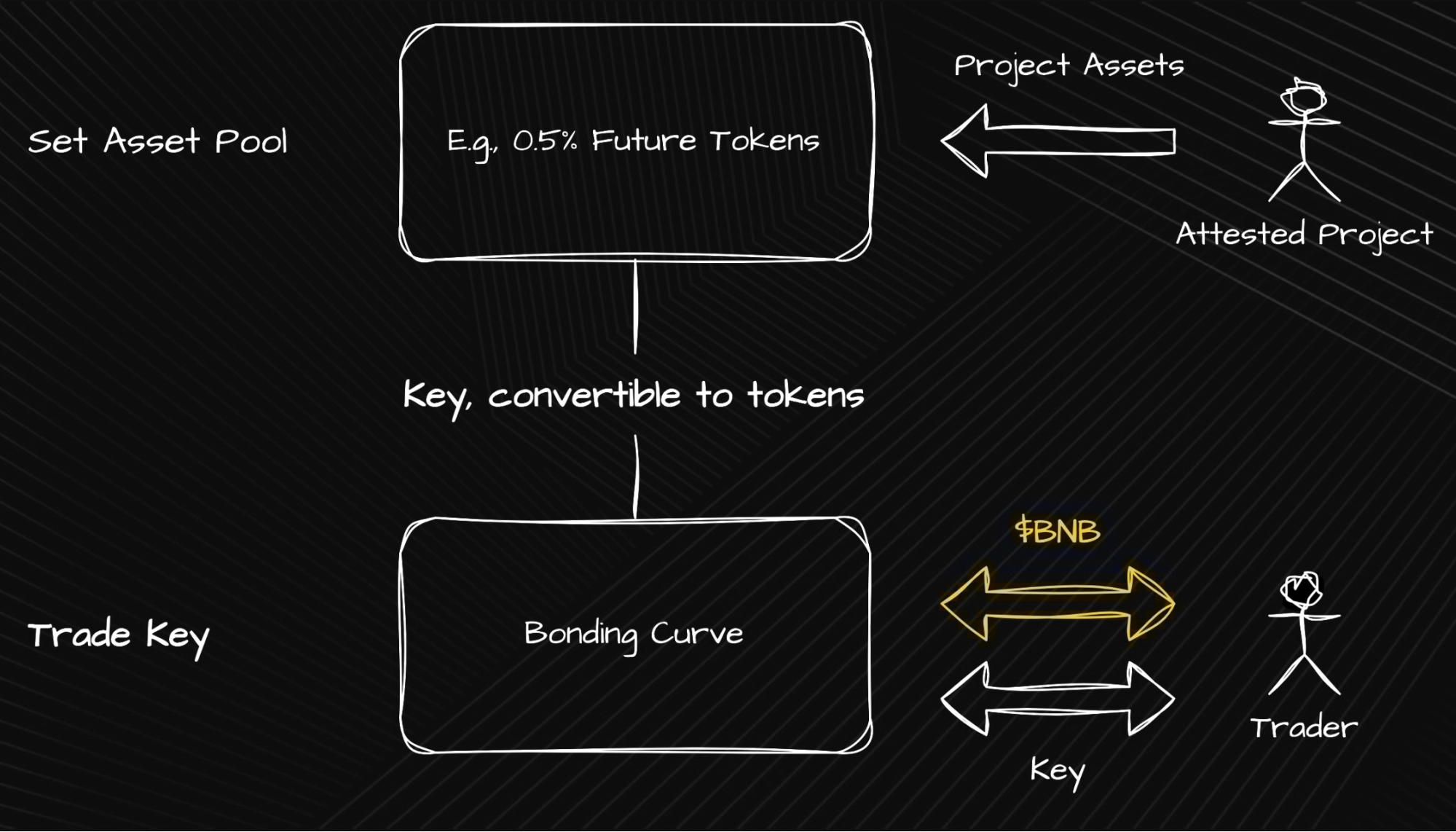

BuildKey enables illiquid assets to be represented as tradable, ERC-20-style tokens. For example, pre-TGE (Token Generation Event) equity, locked tokens, and private placement rights can all be issued and traded on-chain via BuildKey. The system supports multiple pricing models, including AMMs (Automated Market Makers), order books, and auctions, and allows assets to transition between lifecycle stages, such as moving from venture capital investments to public market trading in an on-chain relay.

Since its launch, BuildKey has supported pricing for more than 25 types of digital assets and facilitated over 50 million trades, demonstrating strong market fit for on-chain liquidity of private capital assets. BuildKey is more than a simple token-minting tool; it is a lifecycle asset management platform. Users can enter and exit at various stages—TGE, lockup, or secondary market—while price discovery remains continuous.

Aspecta ID: AI-Powered Trusted Identity Protocol

If BuildKey functions as an asset verification tool, then Aspecta ID acts as the trust infrastructure for issuers. By integrating data such as GitHub commits, on-chain activities, and project contributions, Aspecta ID uses AI algorithms to create credibility profiles for developers, projects, and asset issuers and assigns reputation scores.

This mechanism ensures that asset wrapping does not create a trust vacuum. During early or private phases of a project, the trust output from Aspecta ID helps mitigate concerns for investors and traders. Over 54,000 GitHub developers have already been verified by the system, which is evolving from a trust protocol towards community governance.

Product Integration: Creating a Closed-Loop Ecosystem

Within Aspecta’s architecture, BuildKey and Aspecta ID are closely integrated, forming a complete ecosystem that spans asset creation, trust establishment, and trading. For example, when a developer commits code to GitHub for a specific project, Aspecta ID identifies and evaluates the technical contribution and related on-chain activities, generating a reputation profile. With this trust foundation, the project can issue illiquid assets, such as pre-TGE equity, with clear credibility. These assets are then tokenized through BuildKey, made available for public sale on-chain, and initial price discovery and transaction records are established.

As community participation grows, BuildKey’s AMM, order book, and auction mechanisms further improve asset price transparency and trading depth. Throughout this process, users can decide to subscribe or exit based on the issuer’s reputation score and market pricing, enabling a complete asset lifecycle with verifiable transaction history and value feedback. This system increases early-stage pricing transparency and creates a positive feedback loop between trust and liquidity: Aspecta ID anchors asset credibility, while on-chain trading data strengthens the trust evaluation framework, making subsequent asset issuances more efficient and reliable.

Community, Users, and Ecosystem

As of mid-2025, Aspecta has attracted more than 650,000 users, including over 54,000 GitHub-verified developers who play a key role in building the ecosystem and enhancing the utility and appeal of the identity system. BuildKey has already supported on-chain issuance and trading of over 25 types of illiquid assets, demonstrating broad adaptability to the market. Active community participation is also accelerating the development of features such as multi-chain compatibility and hybrid AMM/order book models, expanding the ecosystem’s openness and flexibility.

In practice, Aspecta is building an “AI + assets + community” infrastructure triangle, aiming to connect identity verification, asset packaging, on-chain governance, and incentives into a seamless, end-to-end workflow. This approach is laying the groundwork for infrastructure-level network effects.

Conclusion

Aspecta is pioneering a method that combines trusted identity, lifecycle asset packaging, and on-chain liquidity mechanisms to bridge the gap between traditional capital and Web3. The product ecosystem continues to evolve, supporting processes from GitHub contributions and token verification to private issuance and secondary market trading. While still in its early stages, BuildKey’s transaction volume of over $50 million and a user base exceeding 650,000 provide a strong foundation.

Disclaimer:

- This article is reprinted from ForesightNews under the original title “What Is Aspecta (ASP), the Next Token to Launch on Binance Alpha?” Copyright remains with the original author (Alex Liu, Foresight News). If you have concerns regarding this reprint, please contact the Gate Learn Team; we will address your request promptly in accordance with our procedures.

- The views and opinions expressed in this article are those of the author only and do not constitute investment advice.

- Other language versions are translated by the Gate Learn Team. Unless explicitly stated by Gate, unauthorized reproduction, distribution, or plagiarism of this translated content is prohibited.