Gate Research: OpenSea Launches Multichain Creation Platform Creator Studio 2.0 | Sui TVL Doubles to Hit New Yearly High

Summary

- OpenSea has launched Creator Studio 2.0, upgrading the multichain publishing and display experience for creators.

- EigenDA V2 is now live on the mainnet, offering a ~6.7x increase in throughput compared to V1.

- CBOE submitted a standardized listing framework for crypto ETPs, with SOL and XRP ETPs likely to launch in Q4.

- Ethereum ETFs saw record-breaking inflows in July, while The Ether Machine expanded its on-chain activity to respond to growing institutional demand.

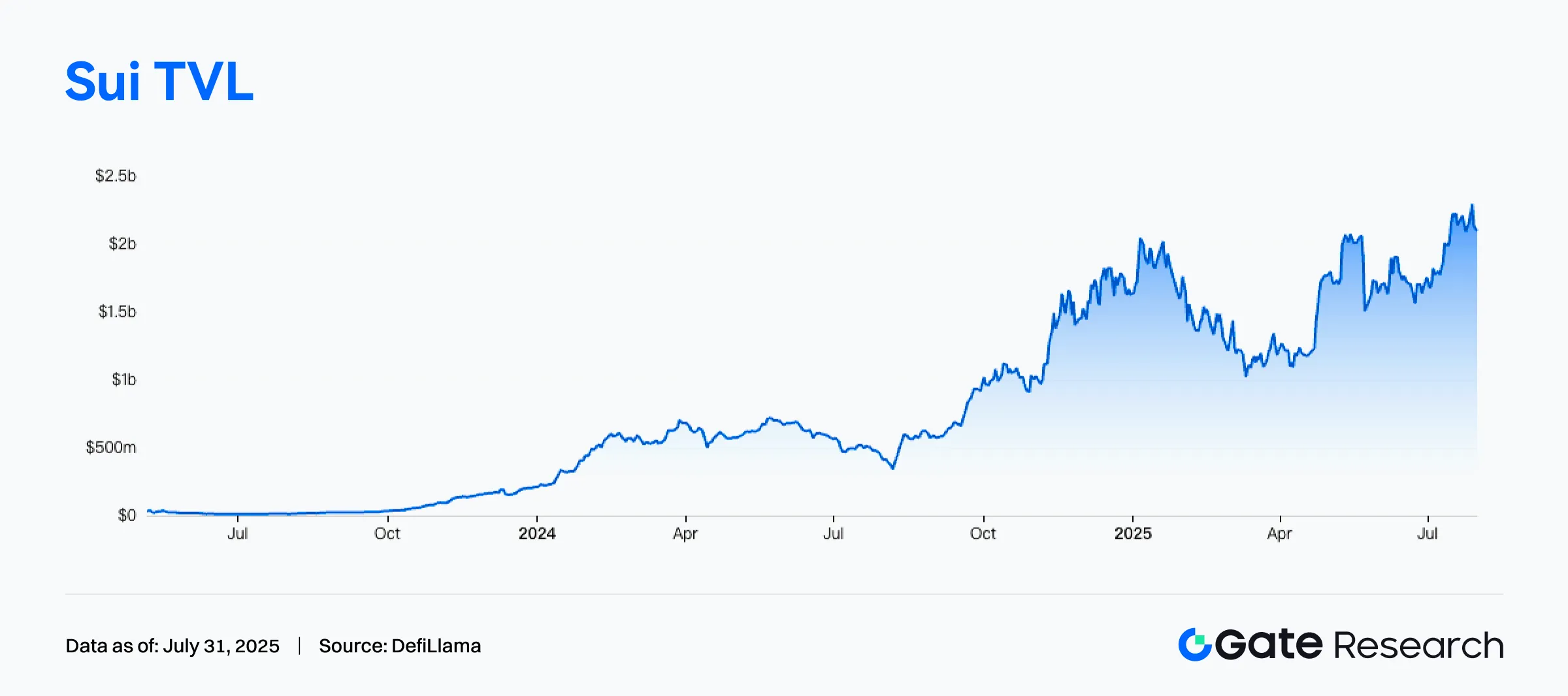

- Sui TVL hit a new all-time high of $2.2B, doubling year-to-date and signaling rapid ecosystem expansion.

- Gate Launchpool launched ALEO, with a total reward pool of 77,942 ALEO.

Market Overview

Market Commentary

- BTC Market — BTC declined 0.73% this week. Early in the week, the price moved upward within the $118,000–$119,500 range, attempting to break through upper resistance. However, from July 30 to 31, BTC experienced a notable pullback, dropping rapidly from around $119,000 to below $116,000. This drop was accompanied by a significant surge in trading volume, indicating strong selling pressure. After hitting the local low, BTC quickly stabilized and rebounded, currently trading around $118,237.4.

- ETH Market — ETH rose 5.47% this week. At the start of the week, ETH moved upward between $3,800–$3,900, briefly reaching a high near $3,940. A clear correction followed between July 29 and 30, with the price dropping quickly from the peak to around $3,720. The pullback was accompanied by rising trading volume, also indicating notable selling pressure. After stabilizing at the bottom, ETH began a rebound and is currently back at $3,845.04. During the rebound, it formed a new consolidation range between $3,760–$3,840.

- Altcoins — Major altcoins showed significant structural divergence this week, with capital flowing into top performers. The trend of “the strong getting stronger” and rapid rotation of market hot spots was evident. Among the top 100 crypto assets by market cap, ENA and CFX gained over 33%, standing out with strong short-term momentum.

- ETFs & Derivatives — BTC ETFs recorded net inflows over the past 5 trading days, reflecting renewed confidence in mid- to long-term prospects. However, ETH ETFs performed even better, maintaining net inflows for several consecutive weeks, often with larger inflow volumes than BTC ETFs. This is largely due to ETH’s stronger price performance compared to BTC, which attracted continued institutional buying. On the derivatives side, BTC and ETH liquidations in the past 24 hours totaled $99.46M and $72.84M, respectively.

- Macroeconomics — On July 30, the Federal Reserve announced it would keep the federal funds rate target range at 4.25%–4.50%, marking the fifth consecutive pause. Following the decision, U.S. stock indices briefly plunged, reversing earlier gains.

- Stablecoins — The total market cap of stablecoins rose to $275.2 billion, indicating additional off-exchange capital flowing into the crypto market.

- Gas Fees — Ethereum network gas fees rose sharply this week. As of July 31, the average daily gas fee reached 2.8 Gwei, significantly higher than the previous week.

Trending Sectors

The cryptocurrency industry continued to rise this week, with market sentiment remaining optimistic and most major altcoin sectors showing gains. According to Coingecko data, the RWA Protocol, Stablecoin Protocol, and Liquid Staking sectors all experienced upward trends over the past seven days, increasing by 248.2%, 20.6%, and 17.5% respectively.

RWA Protocol

RWA Protocols tokenize real-world assets—such as real estate and bonds—using blockchain technology, significantly enhancing asset liquidity and accessibility. They serve as a bridge between traditional finance and the digital economy. Their core value lies in enabling digital management and trading of assets through smart contracts, reducing investment thresholds and increasing transparency. Over the past week, this sector rose by 248.2%, driven by new tokens completing their TGE and being included in the statistics. Notably, APF Coin and Carnomaly surged by 132.6% and 59.7%, respectively.

Stablecoin Protocol

Stablecoin Protocols focus on designing, issuing, managing, and maintaining the stability of assets pegged to a reference value (such as USD, EUR, or gold) within decentralized architectures. Their primary goal is to ensure price stability, predictability, and scalability. This sector gained 20.6% in the last seven days, with Keeta and Ethena rising by 50.3% and 33.6%, respectively.

Liquid Staking

Liquid Staking is a mechanism that tokenizes staked assets, unlocking liquidity for otherwise locked tokens. It allows users to earn staking rewards while still participating in on-chain activities like DeFi. This mechanism has become a key infrastructure component in the DeFi ecosystem. The sector increased by 17.5% over the past week, with Cronos zkEVM CRO and Babylon up by 18.9% and 17.5%, respectively.

Focus of the Week

OpenSea Launches Creator Studio 2.0 to Enhance Multi-Chain Creator Issuance and Display Experience

NFT marketplace OpenSea has officially launched Creator Studio 2.0, offering creators an all-in-one tool for multi-chain creation and issuance. The new version supports creating NFT collections on up to 20 blockchains, scheduling issuance times, and customizing display pages for sharing and storytelling. This upgrade aims to lower the barrier to creation, enhance content expressiveness, and further solidify OpenSea’s core position in the Web3 creator ecosystem. The feature is now fully integrated into OpenSea’s new platform version and widely available.

OpenSea’s Creator Studio 2.0 marks its transformation from a single trading platform into a multi-chain creation and issuance “infrastructure provider.” In the competitive landscape where platforms like Blur focus on “trading efficiency” and “airdrop incentives,” OpenSea chooses to differentiate by empowering creators and building a content ecosystem, aiming to stabilize platform stickiness and increase original content share, reversing user traffic loss. At the industry level, with rapid growth in on-chain NFT activity on Ordinals, Ethereum Layer2, Solana, and others, unified entry points and cross-chain issuance are becoming new trends. Creator Studio 2.0’s multi-chain support and upgraded creative tools will further promote the professionalization and scaling of the Web3 content creation ecosystem.

EigenDA V2 Launches on Mainnet, Throughput Increased by About 6.7x Compared to V1

Modular data availability (DA) solution EigenDA announced the mainnet launch of its V2 version. The new version boosts data throughput to 100 MB/s, approximately 6.7 times that of V1, while reducing average latency from about 600 seconds to just 10 seconds—an improvement of nearly 60 times. This upgrade significantly enhances EigenDA’s performance, providing more efficient data availability support for the Rollup ecosystem.

The release of EigenDA V2 represents another key milestone in modular blockchain architecture development. The “double leap” in throughput and latency not only raises the performance ceiling of data availability but also lays infrastructure foundations for Rollups, L3 architectures, and high-frequency trading applications. EigenDA further consolidates its technological leadership in the DA layer, especially amid ongoing advancements by competitors like Celestia and Avail. This V2 release is expected to attract more Rollup projects and developer integrations. For the crypto industry overall, it signals that lower-cost, faster modular infrastructure will propel on-chain applications from “feasibility verification” toward “large-scale deployment.” Particularly as the Ethereum ecosystem accelerates toward a Rollup-Centric roadmap, EigenDA’s upgrade will become a key underlying component supporting millions of TPS and may drive renewed capital attention and focus on the DA layer sector.

CBOE Files General Listing Framework for Crypto ETPs; SOL and XRP ETPs Expected in Q4

The Chicago Board Options Exchange (CBOE) has submitted a general listing standards application for crypto asset ETPs (Exchange Traded Products) to the U.S. Securities and Exchange Commission (SEC), marking a clearer compliance path for crypto trading products on U.S. equity markets. The standards will apply to crypto assets that have been futures-tracked on compliant derivatives markets (e.g., Coinbase Derivatives) for over six months, covering major tokens like SOL and XRP, with support for related staking mechanisms. Solana ETP approval is expected by October 10 at the latest, followed by XRP ETP in Q4. Meanwhile, the NYSE and Nasdaq may quickly respond with similar filings.

This general listing framework from CBOE is seen as a critical compliance extension following the spot Bitcoin ETF. Unlike prior single-asset ETF application routes, this unified “six months of futures tracking” threshold creates a standardized process applicable to major crypto assets, greatly reducing approval uncertainty. It is expected to promote ETP launches for SOL, XRP in Q4 and may pave the way for staking ETPs for ETH, and productization of second-tier assets like AVAX and LINK.

Key Market Data Highlights

Ethereum ETFs Hit Record Inflows in July; The Ether Machine Adds On-Chain Amid Institutional Entry Surge

Ethereum treasury strategy firm The Ether Machine recently increased its Ethereum holdings by approximately 15,000 ETH, raising total holdings to 334,757 ETH—ranking it among the top on-chain Ethereum treasuries. Valued at about $50 million at current prices, the firm still holds $407 million in deployable capital, demonstrating strong long-term capital management capability and confidence in Ethereum’s medium- to long-term prospects.

This accumulation is part of a broader institutional trend of steadily acquiring Ethereum. Since the launch of spot Ethereum ETFs in 2024, traditional asset managers such as BlackRock and Fidelity have expanded their allocations. In July 2025, ETF net inflows hit a record $5.4 billion—surpassing the total inflows of the previous 11 months combined—highlighting growing institutional consensus on Ethereum as a “blue-chip digital asset.”

Overall, The Ether Machine’s continued accumulation not only reflects firm belief in Ethereum fundamentals but also serves as an on-chain indicator of accelerating institutional capital deployment. With ETFs driving Ethereum’s asset class transformation, such treasury actions have become important signals for long-term capital flow trends.

Sui TVL Hits Record High of $2.2 Billion, Doubling Year-to-Date Reflecting Accelerated Ecosystem Growth

According to DefiLlama data, Sui’s total on-chain TVL surpassed $2.2 billion, nearly doubling from its yearly low, setting a new all-time high. The surge began following the May 22 contract exploit incident at Cetus—the largest DEX aggregator on Sui—which resulted in over $223 million liquidity loss. The team promptly paused the protocol, initiated asset recovery and governance reforms, ultimately reclaiming most assets via community voting and moving to open-source governance, which restored ecosystem transparency and market confidence.

On-chain fundamentals have simultaneously improved. Artemis data shows Sui’s daily active addresses rebounded from about 300,000 post-incident low to 2.6 million, increasing over 130% monthly, reflecting real capital inflows and user return. Meanwhile, SUI has attracted institutional attention; Nasdaq-listed Lion Group bought 350,000 SUI in June and increased holdings to over 1.01 million in July, worth $4.3 million; Everything Blockchain Inc. also added SUI to its $10 million crypto portfolio.

In summary, SUI’s recent rally is driven by a combination of governance improvements, on-chain data recovery, and institutional capital entry, demonstrating strong resilience and long-term growth potential.

Solana DEX Volume Falls Nearly 70% from Year-Start Peak, Ecosystem Activity Temporarily Cooling

DefiLlama data shows Solana DEX’s monthly trading volume peaked over $260 billion in January 2025 but has since declined by nearly 70% by July. This pullback mainly results from the fading meme coin and speculative frenzy that fueled Solana’s high-frequency trading earlier this year, with a sharp drop in short-term capital and bot activity. Additionally, cross-chain capital has flowed back to the Ethereum ecosystem, driven by steady spot ETF inflows, with Layer 2 and restaking protocols diverting significant trading volumes, causing a temporary cooldown in Solana DEX activity.

Despite this, Solana’s infrastructure and protocol innovation remain resilient. Leading DEXs like Raydium and Jupiter still maintain significant market share, and demand for on-chain staking, MEV revenue, and liquid staking token products continues growing. The current volume decline is mainly a cyclical market sentiment shift rather than ecosystem deterioration. Should new token launches, DeFi innovation, and ecosystem incentives restart, Solana’s on-chain liquidity is expected to rebound and DEX volume regain upward momentum.

Gate Launchpool

Project to Watch This Week: ALEO

Aleo is a developer platform designed to build fully private, scalable, and cost-effective applications. Leveraging zero-knowledge cryptography, Aleo moves smart contract execution off-chain, enabling decentralized applications that are both fully private and capable of scaling to thousands of transactions per second.

How to Prepare

- Gate Account: Register and complete identity verification.

- Deposit Funds: Ensure your account has sufficient USDT and ALEO. This Launchpool supports staking in either token.

How to Participate

- Staking Window: Starts on July 31, 2025, at 20:00 and ends on August 3, 2025, at 20:00 (UTC+8).

Steps:

Log in to Gate and navigate to the Launchpool page.

- Select the ALEO project and click Join Now.

- Enter your staking amount and confirm to participate.

- Total Rewards: 77,942 ALEO

- Estimated Annual Yield (APY): 1,154.07%

Funding Weekly Recap

According to RootData, from July 24 to July 30, 2025, a total of 27 crypto projects announced funding or M&A events, covering areas such as Bitcoin finance, Web3 infrastructure, and crypto payments. This highlights ongoing market interest in foundational infrastructure and user application expansion. Below are the top 3 funding rounds by size:

Strategy

Announced on July 25 that it has raised the size of its elastic perpetual preferred equity issuance ($STRC) from $500 million to $2.521 billion.

Strategy focuses on building Bitcoin-native financial infrastructure, including spot asset management, on-chain yield tools, and structured financing products. The capital raise aims to strengthen its balance sheet, improve leverage efficiency, and expand its crypto financing models — signaling strong institutional confidence in its Bitcoin-backed strategy.

MARA (Marathon Digital Holdings)

On July 28, MARA announced the completion of a $950 million convertible note offering, maturing in 2032. As one of the largest Bitcoin mining firms in the U.S., Marathon is transitioning from a pure miner to a Bitcoin capital manager, aiming to enhance its asset influence in the crypto finance sector. The funds will primarily be used to purchase additional Bitcoin and solidify its role as a digital asset reserve company.

RD Technologies

On July 30, RD Technologies completed a $40 million Series A2 round, co-led by ZhongAn International and Sequoia China Seed Fund.

RD Technologies is building next-gen global digital asset payment and account infrastructure. It connects traditional and crypto finance through compliant stablecoins, aggregated payment systems, and cross-border wallet networks. The funding will be used for international expansion, R&D, and compliance.

Next Week to Watch

Token Unlocks

According to Tokenomist, several major token unlocks are expected in the coming week (July 31 – August 7, 2025). The top 3 are:

- SUI: $167 million worth of tokens to be unlocked, accounting for 1.3% of circulating supply.

- ENA: $132 million worth of being unlocked, 3.3% of circulating supply.

- OP: $22.35 million worth of being unlocked, 1.8% of circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Gate, https://www.gate.com/trade/ETH_USDT

- Coinmarketcap, https://coinmarketcap.com/

- Farside Investors, https://farside.co.uk/btc/

- Coinglass, https://www.coinglass.com/LiquidationData

- jin10, https://rili.jin10.com/

- Coinmarketcap, https://coinmarketcap.com/view/stablecoin/

- etherscan, https://etherscan.io/gastracker

- Coingecko, https://www.coingecko.com/en/categories

- X, https://x.com/opensea/status/1950324517978644985

- X, https://x.com/eigen_da/status/1950572491375853759

- X, https://x.com/EricBalchunas/status/1950650033403244602

- X, https://x.com/TheEtherMachine/status/1950681507825070133

- DefiLlama, https://defillama.com/chain/sui

- DefiLlama, https://defillama.com/dexs/chain/solana

- Gate, https://www.gate.com/launchpool/ALEO?pid=351

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.