Bullish, which emerged from EOS, is officially heading to the New York Stock Exchange

On July 19, 2025, CNBC reported that Bullish has officially filed its IPO registration with the U.S. Securities and Exchange Commission (SEC) and plans to go public on the New York Stock Exchange under the ticker “BLSH.” With this move, Bullish joins Circle and Coinbase as the latest crypto company targeting the U.S. equity markets.

The prospectus reveals that, as of Q1 2025, Bullish’s cumulative trading volume reached $1.25 trillion, with average daily trading volume topping $2.5 billion for the quarter. Bitcoin volumes hit $108.6 billion, up 36% year-over-year.

Bullish may not be a household name in the highly profitable centralized exchange (CEX) space, but its pedigree is noteworthy.

In 2018, EOS made headlines as a so-called “Ethereum killer.” Its parent, Block.one, leveraged the excitement to conduct the industry’s largest and longest-ever ICO (Initial Coin Offering), raising a staggering $4.2 billion.

After enthusiasm for EOS faded, Block.one switched gears, launching Bullish—a crypto trading platform focused on compliance and targeting traditional finance. This pivot led the EOS community to essentially cast Block.one out.

Bullish officially launched in July 2021, backed by $100 million in cash from Block.one, 164,000 Bitcoin (about $9.7 billion at the time), and 20 million EOS tokens. External investors kicked in another $300 million, including PayPal co-founder Peter Thiel, hedge fund titan Alan Howard, and prominent crypto investor Mike Novogratz.

Bullish: Compliance-Focused, Aligned With Circle, Distanced From Tether

Bullish set its sights on regulatory compliance from day one, prioritizing it over sheer scale.

The company’s endgame was never about maximizing crypto profits. Instead, Bullish aimed to become a “legit”—and publicly traded—exchange.

Even before it launched, Bullish reached a deal with listed company Far Peak to acquire a 9% stake for $840 million and a $2.5 billion merger. The strategy: a backdoor listing to bypass some of the traditional IPO roadblocks.

At the time, Bullish was valued by the media at $9 billion.

Far Peak’s former CEO, Thomas Farley—now Bullish’s CEO—brought a significant compliance pedigree. He previously served as Chief Operating Officer and President of the New York Stock Exchange, built an impressive track record, and developed strong relationships with Wall Street leaders, CEOs, and institutional investors. He also has extensive experience navigating regulatory and capital market environments.

Notably, Farley’s external investments and acquisitions, though few, include some of crypto’s most prominent projects: Bitcoin staking protocol Babylon, restaking protocol ether.fi, and crypto media outlet CoinDesk.

In essence, Bullish is the crypto exchange that most aspires to become a mainstream Wall Street player.

Yet, that ambition collided with reality. Achieving compliance proved far tougher than anticipated.

As the U.S. regulatory environment grew more stringent, Bullish’s merger/listing deal fell through in 2022, derailing its 18-month IPO timeline. The company also considered acquiring FTX for rapid expansion, but the deal never closed. Bullish was forced to look for new compliant avenues—turning its focus to Asia and Europe.

Bullish at the Consensus conference in Hong Kong

Earlier this year, Bullish secured Type 1 (securities trading), Type 7 (automated trading services), and virtual asset trading platform licenses from the Hong Kong Securities and Futures Commission. It also obtained the necessary trading and custody licenses for crypto assets from Germany’s Federal Financial Supervisory Authority (BaFin).

Bullish employs around 260 people globally—over half in Hong Kong, with the rest based in Singapore, the U.S., and Gibraltar.

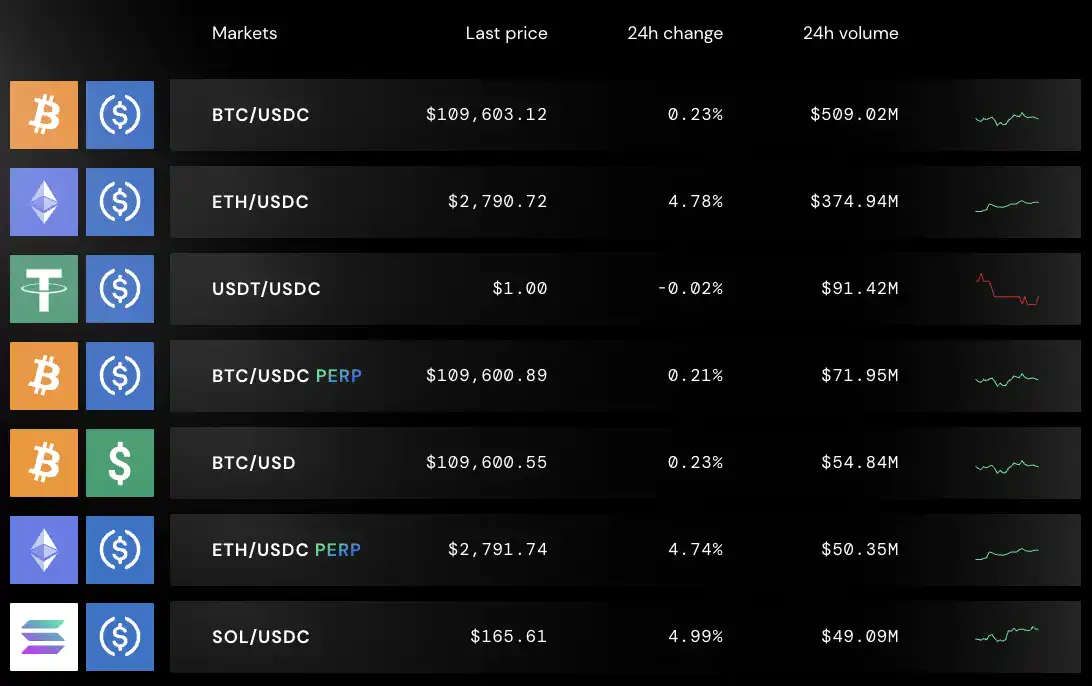

Bullish’s compliance-first philosophy is also evident in its preference for Circle (USDC) over Tether (USDT).

On Bullish, the top stablecoin trading pairs are with USDC, not USDT—despite USDT’s larger circulation and longer track record. This underscores Bullish’s clear stance on regulatory alignment.

In recent years, USDT has come under increasing SEC scrutiny in the U.S., eroding its dominance. In contrast, USDC, jointly launched by compliant firms Circle and Coinbase, successfully went public, earning favor as “the first stablecoin stock” with strong market performance. USDC’s transparent and regulatory-friendly design has fueled steady growth in trading volume.

According to the latest Kaiko report, USDC trading volume on centralized exchanges soared in 2024, hitting $38 billion in March—far higher than the $8 billion monthly average in 2023. Bullish and Bybit account for about 60% of this volume combined.

Bullish and EOS: A Story of Betrayal and Rebranding

If you had to describe the relationship between Bullish and EOS in a word, it would be “exes versus new love.”

After news broke of Bullish’s confidential IPO filing, A (formerly EOS) spiked 17%. But relations between EOS’s community and Bullish have been frosty ever since Block.one abandoned EOS for Bullish.

Back in 2017, public blockchains were booming. Block.one released the EOS white paper, touting a “million TPS, zero fees” superchain that drew a wave of global investors. In a year, EOS raised $4.2 billion via ICO—a new industry record and the embodiment of “Ethereum killer” dreams.

But the dream didn’t last. After EOS launched its mainnet, users quickly realized the tech wasn’t as invincible as advertised. Transfers were fee-free, but required staking CPU and RAM—an onerous process with a steep learning curve. Node elections also proved less “democratic” than hoped, quickly becoming dominated by whale investors and exchanges, sparking allegations of vote-buying and collusion.

What truly accelerated EOS’s decline, however, was less about technology than about how Block.one managed its resources.

Block.one originally pledged to inject $1 billion into the EOS ecosystem. In practice, however, it did the opposite: bulk buying U.S. Treasuries, hoarding 160,000 BTC, betting on failed ventures like Voice, speculating on equities and domains, and contributing very little to EOS developer support.

Internally, Block.one was tightly controlled by its founder, BB, and his inner circle, creating a “family business” dynamic. After BM left in 2020, Block.one and EOS began a total split.

Bullish’s emergence was the final straw for the EOS community.

Block.one founder BB

In 2021, Block.one announced the Bullish crypto exchange, boasting $10 billion in investment from top names including PayPal’s Peter Thiel and Wall Street’s Mike Novogratz. Bullish was pitched as a compliant, institutional-grade crypto bridge.

But Bullish’s tech stack and branding share virtually nothing with EOS—it doesn’t use EOS technology, doesn’t accept EOS tokens, doesn’t acknowledge any ties, and offered no thanks to EOS at all.

For the EOS community, it felt like public betrayal: Block.one exploited the resources generated by EOS to build its “new flame.” EOS was simply left behind.

The backlash was swift. Late in 2021, the community organized a “fork rebellion” to sever Block.one’s control. The EOS Foundation led negotiations, but talks stalled. Ultimately, with 17 nodes onboard, the EOS Foundation stripped Block.one’s rights and ousted it from governance. In 2022, the EOS Network Foundation sued Block.one for broken ecological promises; by 2023, the community considered a hard fork to fully isolate Block.one and Bullish’s assets.

Further reading: “EOS Node Suspends Block.one: The Account’s Removal by Community Action.”

After the split, EOS’s community spent years in legal battles over ICO funds, but Block.one still retains full control and ownership.

To many EOS participants, Bullish isn’t so much a “new project” as a symbol of betrayal—an IPO-bound “new lover” that cashed in their ideals for business reality: flashy, but disgraceful.

In 2025, EOS officially rebranded as Vaulta to cut ties with its past, building a Web3 banking platform atop its chain and rebranding the EOS token as “A.”

Block.one: “Overflowing with Wealth”—But Where Did the Money Go?

Block.one’s $4.2 billion ICO was the largest in crypto history—supposedly enough to sustain EOS’s long-term growth and ecosystem. Yet when EOS developers sought support, Block.one handed out a mere $50,000 check, barely covering two months’ salary for a Silicon Valley engineer.

“Where did the $4.2 billion go?” the community demanded.

In a March 19, 2019 email to Block.one shareholders, BM disclosed that, as of February 2019, Block.one held $3 billion in assets (including cash and outside investments), with $2.2 billion in U.S. Treasuries.

The breakdown of the $4.2 billion? Primarily: $2.2 billion in Treasuries (for stability and returns); 160,000 BTC; and smaller investments in stocks and acquisitions (like the failed Silvergate stake and Voice.com domain).

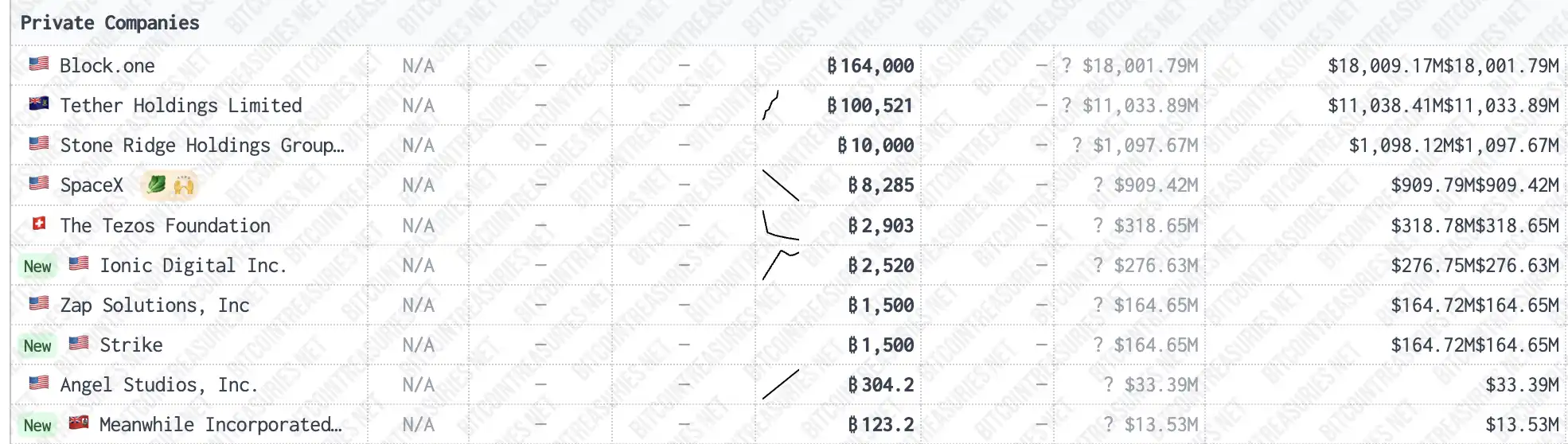

Few realize Block.one, EOS’s founding company, is now the world’s largest private bitcoin holder—with 160,000 BTC, outpacing even Tether by 40,000 coins.

Source: bitcointreasuries

At today’s price of $117,200 per bitcoin, that stash is valued at about $18.752 billion. Just from BTC appreciation, Block.one has pocketed over $14.5 billion—more than 4.4 times its original ICO haul.

From a cash management perspective, Block.one is a resounding success—even more forward-thinking than MicroStrategy, and among the most profitable project teams in crypto history. But the profits didn’t come from “building a great blockchain”—they came from capital preservation, asset growth, and well-timed exits.

This perfectly encapsulates the paradox of crypto: In the end, it’s not always the most innovative or idealistic players who win, but those best at compliance, reading the landscape, and protecting their capital.

Disclaimer:

- This article was reprinted from [BLOCKBEATS]. Copyright belongs to the original author [Peggy, Jaleel加六]. For republication concerns, please contact the Gate Learn team, and our team will address the matter promptly according to relevant procedures.

- Disclaimer: The views and opinions in this article are solely those of the author and do not constitute investment advice.

- Other language versions were translated by the Gate Learn team. Do not copy, distribute, or use translated versions of this article without explicit reference to Gate.